The passage of House Bill 0028 (HB0028), known as the Illinois Receivership Act, marks a pivotal shift in how financially distressed assets, especially commercial real estate are handled in Illinois. Enacted to modernize and standardize receivership proceedings, the law offers substantial implications for businesses operating in or dealing with distressed assets in the state.

Modeled after the Uniform Commercial Real Estate Receivership Act (UCRERA), HB0028 replaces decades of fragmented legal precedents and piecemeal statutory guidance with a cohesive legal framework. As a result, it offers businesses, lenders, investors, and courts a far clearer path forward when confronting insolvency or default issues tied to commercial real estate.

Here’s an in-depth look at how this new law will affect businesses in Illinois, both directly and indirectly, across four key dimensions and why it could be a game changer for the state’s financial and real estate ecosystem.

1. Modernized Receivership Process – A Clearer Legal Roadmap for All Parties

Prior to HB0028, Illinois courts operated under a patchwork system when it came to receiverships. Judges leaned on common law, inconsistent local practices, and vague statutory provisions that varied from one jurisdiction to another. This legal ambiguity often discouraged creditors from pursuing receivership as a remedy and confused debtors about their rights and responsibilities.

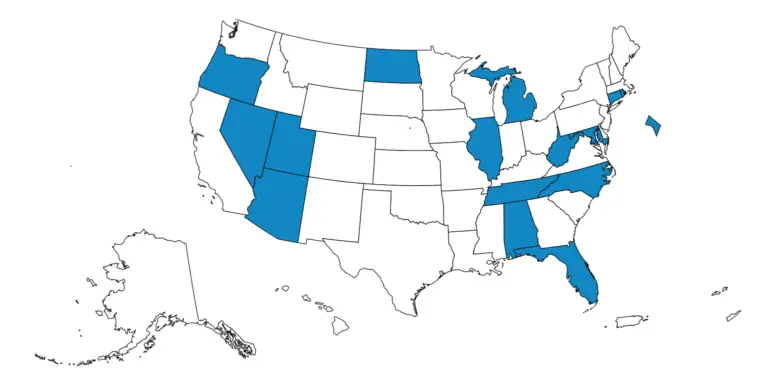

With HB0028, the state adopts a uniform legal standard that provides greater clarity on the appointment, powers, and responsibilities of receivers. This modernization aligns Illinois with a growing number of states that have implemented UCRERA-based reforms.

Key Benefits:

- Improved Predictability: Lenders and borrowers now operate under a more predictable legal framework, reducing surprises during litigation.

- National Consistency: For businesses operating in multiple states, having consistent rules across jurisdictions eases compliance burdens and simplifies strategic planning.

- Streamlined Proceedings: Courts now have more explicit guidance on how to administer receiverships, reducing delays and legal costs.

This structured approach benefits all parties, especially secured creditors and commercial landlords by allowing them to better anticipate outcomes, assess risks, and resolve distressed situations more efficiently.

2. Enhanced Creditor Protections – Stronger Remedies and Faster Resolution Paths

One of the most impactful changes under HB0028 is the strengthened legal position of secured creditors. The law provides more formalized and enforceable avenues to appoint receivers over collateral assets, particularly in the event of loan defaults.

Why It Matters:

Under previous law, even if a lender had the right to appoint a receiver under a loan agreement, actually getting one approved by a court could be inconsistent or time-consuming. HB0028 eliminates much of this uncertainty.

Enhanced Creditor Tools Under the Act:

- Receivership Appointment Rights: Secured creditors now have clearer standing to request a receiver, including during foreclosure or asset disputes.

- Receiver’s Expanded Powers: Receivers can collect rents, manage or sell properties, and make decisions previously subject to legal ambiguity.

- Priority Enforcement: The Act gives courts tools to prioritize creditor claims and maintain value in the underlying asset, reducing the chance of further deterioration during disputes.

For businesses, this means greater accountability during financial distress. While debtors might face increased oversight, the tradeoff is a more orderly process that can lead to quicker restructuring, fewer court battles, and potentially better outcomes than full liquidation or bankruptcy.

3. Business Continuity During Distress – Preserving Operations, Value, and Jobs

Perhaps the most practical and immediate benefit of HB0028 is its emphasis on keeping businesses operational during distress. Rather than forcing abrupt shutdowns or liquidations, the law provides tools for maintaining day-to-day operations through court-appointed receivers.

This approach is crucial for:

- Retail and service businesses operating on leased premises.

- Commercial tenants in buildings subject to foreclosure.

- Manufacturers or distributors occupying property used as loan collateral.

Benefits for Businesses:

- Continuity of Operations: Receivers are empowered to maintain, lease, or manage properties without disrupting business functions.

- Preservation of Value: Keeping a business alive preserves contracts, customer goodwill, and employee jobs, all of which can increase recovery value for creditors.

- Alternative to Bankruptcy: For some distressed entities, receivership now offers a viable, more cost-effective alternative to bankruptcy, which can be prohibitively expensive and time-consuming.

For example, a company facing foreclosure on its facility may now remain operational under a receiver, continuing to generate revenue and potentially negotiating a path to recover, refinance, or sell its business assets.

In short, the Act reframes receivership not as a death sentence but as a transitional remedy that allows for business salvage, restructuring, or repositioning.

4. Increased Out-of-State Investment, Making Illinois More Competitive Nationally

By adopting UCRERA standards, Illinois is now part of a growing group of states using consistent rules for commercial real estate receivership. This alignment makes Illinois more attractive to national and international lenders, investors, and asset managers.

Why This Matters:

- Familiarity: Investors from other UCRERA-aligned states can now operate in Illinois without learning a whole new set of rules.

- Risk Reduction: Clear receivership rules lower risk for lenders, especially when underwriting distressed assets or entering foreclosure-heavy markets.

- Capital Inflows: More clarity means more confidence, and that tends to attract capital, particularly from institutional investors and private equity funds focused on distressed real estate.

This reform comes at a critical time, as Illinois continues to deal with urban property vacancies, post-pandemic office challenges, and rising commercial loan defaults. By creating a more transparent, professional, and nationally compatible receivership process, HB0028 supports economic revitalization, especially in underinvested or transitional markets.

Additional Considerations – Practical Impacts for Stakeholders

Beyond the four primary benefits, the Illinois Receivership Act introduces ripple effects that touch a wide range of stakeholders in the business and legal community:

A. For Lenders and Financial Institutions

- Reduced litigation costs due to greater clarity.

- More predictable recovery outcomes.

- Faster enforcement timelines.

B. For Business Owners and Debtors

- Greater incentive to cooperate with creditors to avoid or manage receivership.

- Potential for ongoing operations during financial restructuring.

- Clearer understanding of rights, duties, and timelines.

C. For Receivers and Attorneys

- A standardized framework for receivership appointments and reporting.

- Expanded statutory authority to manage, lease, or sell assets.

- Opportunities for growth in specialized receivership services.

D. For Courts

- Reduction in legal inconsistencies and case backlog.

- Tools to handle complex commercial property issues more efficiently.

- Better alignment with national legal trends and best practices.

Potential Challenges and Areas to Watch

While HB0028 is widely seen as a positive development, it also introduces new responsibilities and potential risks:

- Judicial Discretion: The Act still allows significant discretion by courts, which could lead to inconsistent applications if not properly guided.

- Abuse Concerns: Some worry that creditors could use the Act more aggressively, leveraging receivership to pressure debtors prematurely.

- Receiver Accountability: With increased power comes the need for oversight, courts and parties must ensure receivers are qualified, neutral, and acting in the best interest of the estate.

To mitigate some of these concerns, it is critical to appoint a qualified and experienced receiver, such as the office of the Illinois Receiver, Arthur R. van der Vant. With a proven track record in managing complex receivership cases, Mr. van der Vant brings the professional expertise, fiduciary discipline, and operational know-how necessary to preserve value, ensure transparency, and maximize stakeholder outcomes. His experience serves not just the appointing court, but also the creditors, debtors, tenants, and all parties involved in the receivership process. By placing receivership in the hands of seasoned professionals, stakeholders can fully leverage the benefits of HB0028 turning potential risks into structured resolutions and long-term recovery.

A Strategic Tool for Modern Business Challenges

The Illinois Receivership Act (HB0028) is more than just a legal update, it’s a strategic tool for managing financial distress, attracting investment, and modernizing Illinois’ commercial real estate ecosystem. For businesses, it offers a more rational, structured, and transparent way to deal with insolvency risks without immediately resorting to bankruptcy or asset liquidation.

As implementation unfolds, the Act is poised to reshape how Illinois handles distressed assets empowering creditors, protecting business continuity, and encouraging outside investment. For businesses, legal professionals, and investors alike, understanding HB0028 is no longer optional, it’s essential.

For more information or to initiate a receivership appointment, visit IllinoisReceiver.com or contact (312) 607-4646.

By: Arthur R. van der Vant, Illinois Receiver https://illinoisreceiver.com/