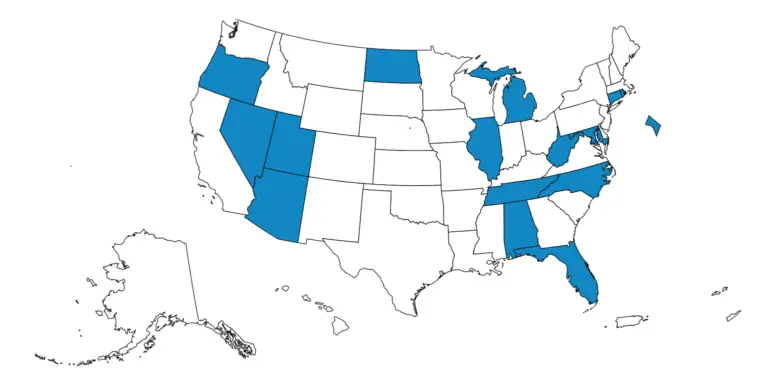

In this article, I want to talk about three (3) potential applications of receiverships under the proposed Illinois Receivership Act: (I) Appointment of a receiver for tangible property; (II) Appointment of a receiver for intangible property; and, (III) Strategic Uses of a Receiver for Business Asset Spin-Offs.

Under the forthcoming Illinois Receivership Act (HB0028), a court-appointed receiver can be designated to manage and protect property in various situations where immediate intervention is necessary. The Act establishes a framework for receiverships involving real property, personal property related to or used in operating the real property, personal property and fixtures, and other business assets such as corporations, limited liability companies, and trusts.

(I) Here are several scenarios where a receiver might be appointed for tangible property under the new legislation:

1. Municipal Intervention in Neglected Properties

Municipalities can petition for the appointment of a receiver to address properties that pose immediate and irreparable harm due to neglect. This includes situations where property owners fail to comply with building codes, leading to unsafe or deteriorating conditions. The receiver would be authorized to manage and rehabilitate the property to prevent further damage.

2. Commercial Foreclosures and Property Management

In commercial foreclosure cases, mortgagees may seek the appointment of a receiver to manage and operate the property during the foreclosure process. The receiver can handle rent collection, property maintenance, and other operational aspects to preserve the property’s value until the foreclosure is resolved.

3. Business Disputes and Asset Protection

In disputes involving business ownership, such as shareholder disagreements or allegations of mismanagement, a receiver can be appointed to manage the business and protect its assets. This is particularly relevant when there are concerns about the suspension of business operations or threatened depreciation of corporate assets.

4. Utility Service Termination and Tenant Protection

Tenants or utility companies may petition the court for the appointment of a receiver when utility services are threatened with termination due to the landlord’s failure to pay. The receiver would collect rents from tenants to ensure continued utility services and maintain the habitability of the property.

5. Health and Safety Concerns

Receivers can be appointed at the request of state or local health officials under public health laws to address properties that have become blighted or pose health and safety risks. The receiver’s duties may include rehabilitating, vacating, liquidating, or demolishing the property to protect public health.

The Illinois Receivership Act provides a legal mechanism for addressing situations where property is at risk due to neglect, mismanagement, or other urgent circumstances. By appointing a receiver, courts can ensure that property is preserved and managed appropriately during the resolution of underlying issues.

(II) Applications for a Receiver to Manage Intangible Property and Rights

Under the forthcoming Illinois Receivership Act (HB0028), a receiver can be appointed to manage not only tangible property but also intangible assets, enforce judgment collections, and protect various rights. The Act provides comprehensive authority for receivers to oversee all forms of receivership property, which encompasses both real and personal property, including intangible assets and rights.

1. Enforcement of Judgment Collections

A receiver may be appointed to enforce a judgment and collect debts owed to the judgment debtor. This includes:

- Collecting Receivables: The receiver can collect debts owed to the debtor, including accounts receivable, loans, and other financial obligations.

- Legal Actions: Initiating legal proceedings to recover debts, such as filing lawsuits or pursuing garnishments.

- Asset Recovery: Identifying and recovering assets that may have been concealed or improperly transferred.

2. Management of Business Interests and Intellectual Property

In cases involving business disputes or insolvency, a receiver can manage intangible assets such as:

- Intellectual Property: Overseeing patents, trademarks, copyrights, and trade secrets to preserve and potentially monetize these assets.

- Business Interests: Managing ownership interests in partnerships, corporations, or limited liability companies, including enforcing shareholder agreements and resolving disputes.

- Contracts and Agreements: Enforcing or terminating contracts, leases, and licenses to protect the value of the business.

3. Protection of Legal Claims and Causes of Action

A receiver may assert and manage legal claims on behalf of the estate or business, including:

- Litigation: Initiating or continuing lawsuits to protect the interests of creditors or stakeholders.

- Claims Recovery: Pursuing claims against third parties for damages or breaches of contract.

- Defending Actions: Defending against lawsuits that may adversely affect the estate or business.

4. Oversight of Financial and Legal Documents

Receivers have the authority to manage and oversee various financial and legal documents, including:

- Financial Records: Reviewing and maintaining financial statements, tax returns, and accounting records.

- Legal Documents: Managing legal filings, court orders, and compliance with regulatory requirements.

- Asset Documentation: Identifying and cataloging intangible assets, such as digital assets and electronic records.

The Illinois Receivership Act empowers receivers to take comprehensive actions to manage and protect all forms of property, including intangible assets and rights. This ensures that all aspects of a debtor’s estate are appropriately administered, preserving value for creditors and stakeholders.

(III) Strategic Uses of a Receiver for Business Asset Spin-Offs

1. Segregating Unprofitable or Liabilities-Ridden Assets

- A business (e.g., a corporation or LLC) may seek the appointment of a receiver to take control of a division, subsidiary, or set of assets that are underperforming, facing legal exposure, or are otherwise detrimental to the health of the main entity.

- This allows the core, profitable portions of the business to continue operating without being dragged down by distressed assets or litigation.

2. Liquidating or Winding Down “Bad” Assets

- A receiver can be empowered by court order to sell, wind down, or dissolve non-performing assets, including toxic real estate, defunct subsidiaries, or debt-heavy units.

- The receiver acts neutrally under court supervision, thereby insulating the parent entity from claims of fraudulent transfer or bad faith.

3. Defending Against Lawsuits and Legal Actions

- If the spun-off assets are subject to ongoing litigation or regulatory scrutiny, the receiver can: (a) Step into the shoes of the entity to respond to claims. (b) Negotiate settlements or restructure obligations. (c) Manage litigation to prevent default judgments.

- This legal firewall can shield the main entity from direct legal entanglement.

4. Preserving Going Concern Value or Facilitating Reorganization

- In more complex cases, a receiver might be used not just for liquidation, but also for reorganization of a troubled unit, especially where: (a) The business has potential value if restructured. (b) A sale as a going concern is more profitable than a piecemeal liquidation.

5. Maintaining Creditor Confidence and Stakeholder Equity

- In voluntary or court-approved receivership, the optics and legality of separating distressed assets via a receiver may help reassure: (a) Secured creditors (who may fear collateral depletion), (b) Investors (concerned with liability contagion), and (c) regulators (monitoring fiduciary responsibility).

Legal Framework in Illinois (under HB0028 and case law)

- HB0028 allows for the appointment of a receiver over a business entity or its assets when: (a) There is risk of dissipation or mismanagement. (b) It serves the purpose of preserving property or enforcing rights. (c) It is in the interest of justice, creditors, or parties in interest.

- Courts already recognize receiverships as equitable tools in: (a) Business breakups or dissolutions. (b) Insolvency and creditor disputes. (c) Minority shareholder oppression or deadlock. (c) Fraudulent conveyance avoidance

Important Considerations

- A court must approve the receivership and define its scope via order.

- The petitioning party (often the business itself, or a creditor) must show: (a) The assets are at risk of loss or (b) There is just cause (e.g., fraud, insolvency, or imminent harm).

- The business must clearly separate receivership-bound assets from its core operations to avoid veil-piercing or fraudulent transfer issues.

Example Use Case

ABC Real Estate LLC owns 10 properties. Two are under EPA investigation and have massive environmental liabilities. Rather than jeopardizing the entire LLC, ABC petitions for a receiver to be appointed specifically over those two assets. The receiver:

- Takes over management,

- Handles regulatory compliance,

- Works to liquidate or remediate the properties,

- While ABC continues to operate profitably with the remaining eight.

Summary

Yes, Illinois courts can appoint a receiver to isolate, manage, unwind, or liquidate “bad” or liability-laden assets from a corporate entity. This approach can effectively protect the healthy parts of the business while addressing legal or financial threats in a court-supervised, structured manner. HB0028 makes this process more standardized and accessible.

The Illinois Receivership Act introduces standardized procedures, due process protections, and clear guidelines for receivers. Appointing Illinois Receiver ensures adherence to these provisions, fostering trust and efficiency in the receivership process.

For a receiver who combines legal acumen, operational efficiency, and a client-centric approach, Illinois Receiver is the optimal choice. Entrust your receivership cases to Illinois Receiver to experience professionalism and results that align with the highest standards of the Illinois Receivership Act. For more information or to initiate a receivership appointment, visit IllinoisReceiver.com or contact (312) 607-4646.

By: Arthur R. van der Vant

Illinois Receiver