The Illinois Receivership Act, HB0028, represents a significant shift in how distressed properties are managed and rehabilitated under court supervision. By granting receivers the authority to take control of properties, rehabilitate them, and sell them to recover debt, the legislation aims to streamline the property recovery process, especially in cases of foreclosure, disrepair, or financial distress. However, with this newfound authority comes the need for judicial oversight, ensuring that the process remains transparent, equitable, and legally sound for all involved parties.

This article will examine the vital role of courts in overseeing receiverships under HB0028. It will explore how judicial oversight helps balance the need for efficiency with the necessity of accountability, ensuring that due process is followed and that all parties—property owners, creditors, and the public—are protected throughout the receivership process.

The Importance of Judicial Oversight in HB0028

Judicial oversight is the cornerstone of HB0028, as the Act places significant control in the hands of a court-appointed receiver. While receivers have the authority to manage and rehabilitate properties, it is the court that ensures this authority is exercised fairly and in accordance with the law. Without this oversight, there is a risk that receivers could act in ways that benefit certain parties at the expense of others.

The primary function of the court in HB0028 is to ensure due process for all parties involved. This includes overseeing the appointment of receivers, reviewing rehabilitation plans, approving sales, and ensuring that creditors and property owners are treated fairly throughout the process. The court acts as a neutral party, balancing the interests of the property owner, creditors, and other stakeholders while maintaining the integrity of the receivership process.

The Role of the Court in Appointing a Receiver

One of the first and most crucial decisions under HB0028 is the appointment of the receiver. Under the law, the court must evaluate the circumstances surrounding the distressed property to determine whether a receivership is necessary. This decision typically arises from a petition filed by the property owner or a creditor, often in cases of foreclosure, unpaid taxes, or a property in disrepair.

The court’s role is to assess the need for a receiver and to ensure that the receiver is an independent and qualified professional. This means that the judge must consider factors such as:

- The severity of the property’s distress.

- The likelihood that a receiver will be able to successfully rehabilitate the property.

- The qualifications and experience of the proposed receiver.

By ensuring that the receiver is impartial and equipped to handle the property’s challenges, the court lays the groundwork for an equitable and effective receivership process. Without judicial oversight at this stage, there could be a risk of appointing a receiver with conflicts of interest or insufficient expertise, which would undermine the fairness of the entire process.

Court Approval of the Rehabilitation Plan

Once a receiver is appointed, the next critical juncture for judicial oversight comes when the receiver submits a rehabilitation plan to the court. The rehabilitation plan outlines the steps the receiver intends to take to address issues such as structural damage, safety violations, and general disrepair. It also includes the budget for repairs, an estimated timeline, and the anticipated outcomes.

The court’s review of this plan is crucial for several reasons:

- Ensuring Fairness and Transparency: The court’s involvement ensures that the receiver’s actions are transparent and accountable. By reviewing the plan, the court ensures that the proposed repairs are necessary, reasonable, and likely to restore the property to a marketable condition.

- Protecting Stakeholders: The court also ensures that the rehabilitation plan is in the best interest of all stakeholders, including creditors and the property owner. If creditors are owed significant amounts of money, the court must ensure that the rehabilitation plan does not unnecessarily delay or diminish the potential for recovering those debts.

- Preventing Wasteful Spending: The court helps guard against excessive or inappropriate expenditures that could deplete the funds meant for rehabilitating the property. By scrutinizing the proposed budget, the court can identify any potential areas of waste or inefficiency.

- Balancing Timeliness and Thoroughness: While efficiency is important, it is equally vital that the rehabilitation process is thorough. The court must ensure that the receiver does not rush through necessary repairs just to expedite the sale process, as this could result in a subpar rehabilitation and lower the property’s market value.

Through these checks, the court ensures that the receiver is acting in accordance with the principles of fairness, transparency, and fiduciary responsibility. These safeguards help preserve the integrity of the process and prevent parties from exploiting the receivership for personal gain.

Court Oversight of the Sale Process

After the property has been rehabilitated, the receiver’s next task is to sell it. However, under HB0028, no sale can occur without the approval of the court. This critical aspect of judicial oversight helps ensure that the sale is conducted fairly and that the property is not sold for an undervalued price, potentially harming creditors or property owners.

The court’s role during the sale process includes:

- Ensuring Fair Market Value: One of the most significant concerns in receivership sales is that the property may be sold at an unfairly low price, especially if there is pressure to quickly liquidate the property to recover debts. Judicial oversight helps ensure that the property is sold at fair market value, protecting the interests of creditors, property owners, and any other stakeholders.

- Reviewing the Sale Process: The court ensures that the sale process is conducted in a transparent and open manner, giving all interested parties the opportunity to participate or submit competing offers. This prevents the receiver from selling the property behind closed doors or to a favored buyer without giving others the opportunity to bid.

- Approving the Sale Terms: In addition to evaluating the sale price, the court also approves the terms of the sale, including any contingencies, payment terms, or other conditions. This provides another layer of protection, ensuring that the terms are equitable and in the best interest of the parties involved.

- Protecting Property Owners: The court also ensures that the property owner’s interests are protected. If the sale price exceeds the debts owed, the court ensures that the surplus funds are returned to the owner. This is particularly important for individuals who may lose their property due to foreclosure but still have a stake in the final outcome.

The Role of Judicial Oversight in Due Process

One of the most fundamental principles of law is due process—the right of all individuals and parties to be treated fairly and to have their interests protected in a legal proceeding. HB0028 integrates due process into the receivership process through the role of the court, ensuring that no party is unfairly treated or deprived of their rights.

Judicial oversight upholds due process in the following ways:

- Ensuring Stakeholder Notification: Courts ensure that all interested parties, including property owners, creditors, and tenants, are notified of receivership proceedings. This allows stakeholders to voice concerns, challenge decisions, or participate in the process if they wish.

- Ensuring Accountability of the Receiver: The receiver’s actions are subject to judicial scrutiny at multiple points throughout the process. This accountability prevents potential abuses of power or conflicts of interest, ensuring that the receiver is acting in the best interest of all stakeholders.

- Allowing for Appeals and Disputes: If a party believes that the receivership process is not being carried out fairly, they have the right to appeal court decisions or file disputes. This provides a safeguard against wrongful actions or decisions made by the receiver or the court.

- Ensuring Transparency in the Distribution of Proceeds: After the sale of the property, the court ensures that the proceeds are distributed fairly, according to the legal priorities set by the court. Creditors are paid first, and any remaining funds are returned to the property owner. This transparent process ensures that all parties receive their rightful share.

Balancing Efficiency with Accountability

HB0028 introduces a more efficient mechanism for rehabilitating and selling distressed properties by empowering receivers to act swiftly and decisively. However, efficiency must never come at the expense of fairness or accountability. Judicial oversight ensures that the process remains balanced, providing the necessary safeguards to prevent abuse or inequity while allowing the receiver to perform their duties effectively.

While judicial oversight can slow down the process at times, especially with reviews and approvals, it is crucial in maintaining the integrity of the receivership system. Without it, there would be no checks on the receiver’s actions, potentially leading to unfair outcomes for property owners, creditors, and other stakeholders.

In balancing these concerns, courts in Illinois are tasked with ensuring that receivership under HB0028 serves its intended purpose: providing a fair, transparent, and efficient mechanism for rehabilitating distressed properties while maintaining due process for all involved parties.

Conclusion

Judicial oversight is a vital component of HB0028, helping to ensure that the receivership process remains both efficient and accountable. Courts play an essential role in overseeing the appointment of receivers, reviewing rehabilitation plans, approving sales, and safeguarding due process throughout the receivership. By balancing the need for efficiency with the necessity of accountability, the courts ensure that the process is fair to property owners, creditors, and all other stakeholders.

While HB0028 provides a framework for resolving distressed properties more quickly, the involvement of the courts ensures that fairness, transparency, and legal integrity remain at the forefront. As receivership under HB0028 becomes more common in Illinois, the judiciary’s role will continue to be indispensable in maintaining the balance between efficiency and accountability, helping to protect the rights and interests of all involved parties.

About the Author

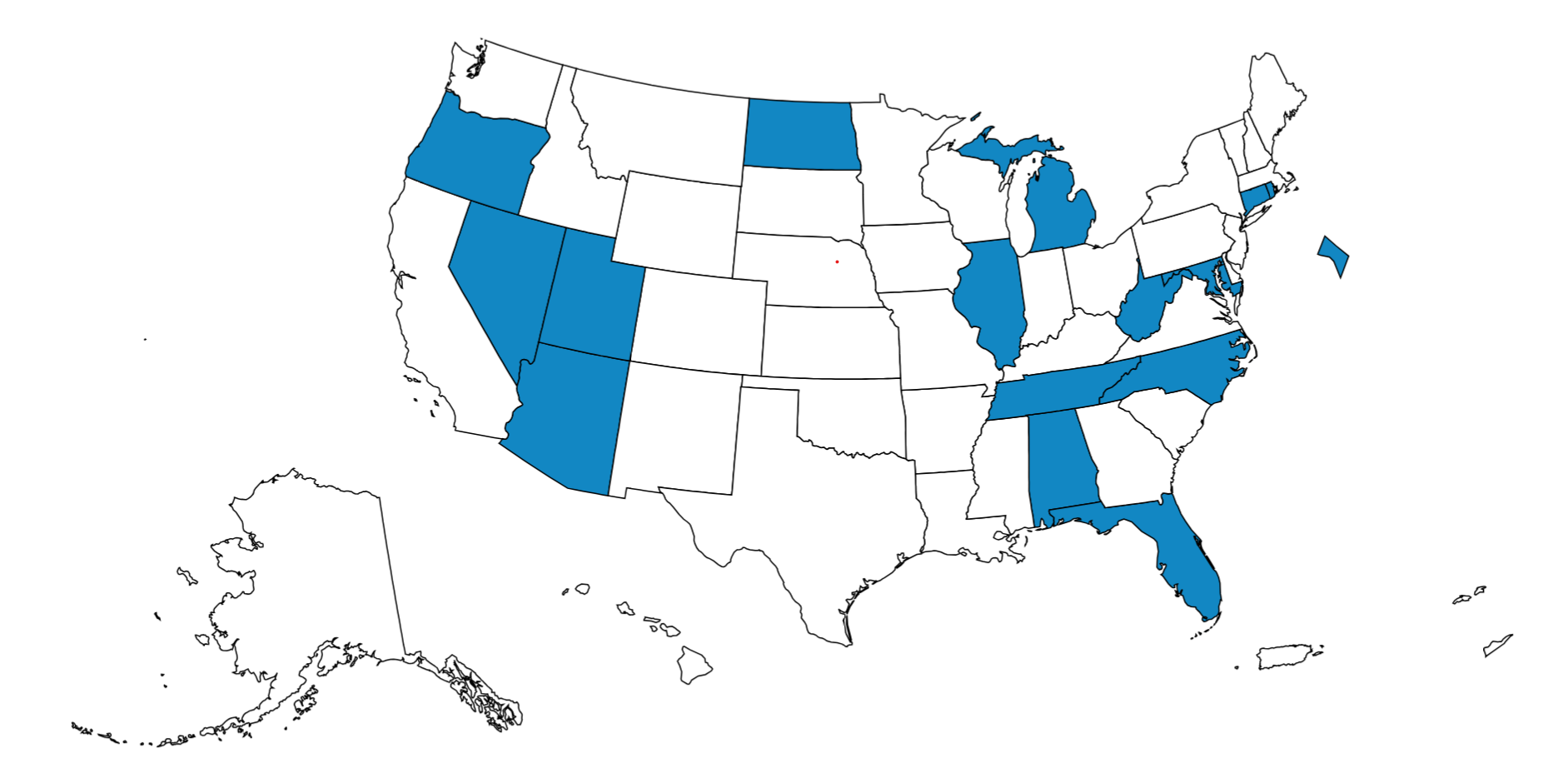

Arthur R. van der Vant is a court-appointed Illinois Receiver with extensive experience in managing distressed properties, businesses, and complex assets under judicial supervision. With a background in real estate, finance, construction, title insurance, property management, and fiduciary administration, Mr. van der Vant has served in many receivership cases throughout the state, working closely with stakeholders to stabilize and reposition properties in recivership. His work emphasizes legal compliance, financial accountability, and community-focused resolution strategies.

Contact

Arthur R. van der Vant Illinois Receiver 312-607-4646 vandervant@IllinoisReceiver.com IllinoisReceiver.com