With the Illinois Receivership Act pending Governor Pritzker’s signature, this article aims to provide an overview of the key provisions to help real estate professionals, lenders, attorneys, and other stakeholders prepare for compliance and capitalize on the opportunities the Act presents.

Please note: This article is for informational purposes only and does not constitute legal advice. Please consult qualified legal counsel regarding your specific circumstances.

Key Provisions

Q. What “Receiver” means?

A. “Receiver” means a person appointed by the court as the court’s agent, and subject to the court’s direction, to take possession of, manage, and, if authorized by this Act or court order, transfer, sell, lease, license, exchange, collect, or otherwise dispose of receivership property.

Q. What “Receivership” means?

A. “Receivership” means a proceeding in which a Receiver is appointed.

Q. What “Receivership Property” means?

A. “Receivership property” means the property of an owner which is described in the order appointing a Receiver or a subsequent order. The term includes any proceeds, products, offspring, rents, or profits of or from the property.

Q. What “Proceeds” means?

A. “Proceeds” means the following property: (A) whatever is acquired on the sale, lease, license, exchange, or other disposition of receivership property; (B) whatever is collected on, or distributed on account of, receivership property; (C) rights arising out of receivership property; (D) to the extent of the value of receivership property, claims arising out of the loss, nonconformity, or interference with the use of, defects or infringement of rights in, or damage to the property; or (E) to the extent of the value of receivership property and to the extent payable to the owner or secured party, insurance payable by reason of the loss or nonconformity of, defects or infringement of rights in, or damage to the property.

Q. What “Owner” means?

A. “Owner” means the person for whose property or business a receiver is appointed.

Q. What “Person” means?

A. “Person” means an individual, corporation, business trust, estate, trust, partnership, limited liability company, association, joint venture, governmental agency, public corporation, or any other legal or commercial entity.

Q. Can a Receiver be appointed by the court on emergency basis?

A. A court can appoint a Receiver without prior notice if the circumstances require issuance of an order before notice is given. A court can also appoint a Receiver after notice and without a prior hearing if the circumstances require issuance of an order before a hearing is held. Additionally, a court can appoint a Receiver after notice and without a hearing if no interested party timely requests a hearing.

Q. What notice must a Receiver give to sell receivership property?

A. In connection with any sale of receivership property under Section 16 of the Illinois Receivership Act, a Receiver must give notice to the owner and all other persons having an interest in the property that would be affected by the sale. With respect to any sale of real property, nonrecord claimants, unknown necessary parties, and unknown owners must be given notice by publication in accordance with Sections 2-206 and 2-207 of the Code of Civil Procedure; and, such other persons as the court directs.

Q. Does the Illinois Receivership Act apply to residential properties?

A. The Illinois Receivership Act does not apply to residential real estate as defined under Section 15-1219 of the Illinois Mortgage Foreclosure Law.

Q. What are other circumstances under which the Illinois Receivership Act does not apply?

A. The Illinois Receivership Act does not apply to a receivership if the Receiver is appointed under: (1) Section 58 of the Illinois Banking Act; (2) Section 10011 of the Savings Bank Act; (3) Section 15.1 of the Currency Exchange Act; (4) Section 6-9 of the Corporate Fiduciary Act; (5) Section 92 of the Transmitters of Money Act; (6) Section 15-1704 of the Illinois Mortgage Foreclosure Law; (7) Section 5 of the Nursing Home Care Act; or (8) any law of this State other than this Act in which the Receiver is a governmental unit or an individual acting in an official capacity on behalf of the unit, except to the extent provided by the other law. Notwithstanding the foregoing, a governmental unit or an individual acting in an official capacity on behalf of the unit may elect for this Act to apply to a receivership to the extent not inconsistent with the other law.

Q. What are the powers of the court under the Illinois Receivership Act?

A. The court that appoints a Receiver under the Illinois Receivership Act has exclusive jurisdiction and authority: (a) To direct and control the Receiver; (b) Over all receivership property wherever located; (c) To determine all controversies related to the receivership or the collection, preservation, improvement, disposition, and distribution of receivership property; and (d) Over all matters otherwise arising in or relating to the receivership, the receivership property, the exercise of the Receiver’s powers, or the performance of the Receiver’s duties.

Q. Can a Receiver be appointed in foreclosure proceedings?

A. Section 6(a)(5) of the Illinois Receivership Act allows a court to appoint a Receiver during the time allowed for redemption, to preserve property sold in an execution or foreclosure sale and secure its rents to the person entitled to the rents.

Q. Other than foreclosure, what are the other instances a Receiver can be appointed?

A. A Receiver can be appointed in connection to enforcement of a lien, if: (1) Appointment is necessary to protect the property from waste, loss, transfer, dissipation, or impairment; (2) The debtor agreed in a signed record to appointment of a Receiver on default; (3) The owner agreed, after default and in a signed record, to appointment of a Receiver; (4) The collateral and any other collateral security held by the secured party are not sufficient to satisfy the secured obligation; (5) The owner fails to turn over to the secured party proceeds or rents the secured party was entitled to collect; or (6) The holder of a subordinate lien obtains appointment of a Receiver for the property.

Q. Who is disqualified to serve as a Receiver?

A. A person is disqualified from appointment as Receiver if the person: (1) Is an affiliate of a party or the judge presiding over the receivership; (2) Has an interest materially adverse to an interest of a party; (3) Has a material financial interest in the outcome of the action, other than compensation the court may allow the Receiver; (4) Has a debtor-creditor relationship with a party; (5) Holds an equity interest in a party, other than a noncontrolling interest in a publicly traded company; (6) Is a sheriff of any county; or (7) is otherwise prohibited from acting as an agent of the court under the laws of this State.

Q. What is Receiver’s status as lien creditor under the Illinois Receivership Act?

A. On appointment of a Receiver, the Receiver has the status of a lien creditor: (1) Under Sections 9-101 to 9-809 of the Uniform Commercial Code as to receivership property that is personal property or fixtures; (2) Under Sections 1 to 39 of the Conveyances Act as to receivership property that is real property as to persons with actual or constructive notice of the appointment and to all other persons from the time of recording of the order appointing the Receiver pursuant to Section 12(c)(3) of this Act; and (3) As if the Receiver were a creditor that obtained a judicial lien on all the receivership property, subject to satisfying the recording requirements as to real property described in Section 12(c)(3) of this Act.

Q. What are the powers of a Receiver?

A. Except as limited by court order or law of this State other than this Act, a Receiver may:

(1) Collect, control, manage, conserve, and protect receivership property;

(2) Operate a business constituting receivership property, including preservation, use, sale, lease, license, exchange, collection, or disposition of the property in the ordinary course of business;

(3) In the ordinary course of business, incur unsecured debt and pay expenses incidental to them receiver’s preservation, use, sale, lease, license, exchange, collection, or disposition of receivership property and otherwise in the performance of the receiver’s duties, including the power to pay obligations incurred prior to the receiver’s appointment if, in the receiver’s business judgment, payment is necessary to preserve the value of receivership property using funds that are not subject to any lien or right of setoff in favor of a creditor who has not consented to the payment;

(4) Incur debt under a secured obligation in effect as of the receiver’s appointment subject to the same terms, conditions, and lien priorities that existed as of the receiver’s appointment;

(5) Assert a right, claim, cause of action, or defense of the owner which relates to receivership property and maintain in the receiver’s name or owner’s name any action to enforce any such right, claim, cause of action, or defense and intervene in actions in which owner is a party for the purpose of exercising any rights pursuant to this subsection 12(a)(5) or requesting transfer of venue of the action to the court;

(6) Seek and obtain instruction from the court concerning receivership property, exercise of the receiver’s powers, and performance of the receiver’s duties;

(7) On subpoena, compel a person to submit to examination under oath, or to produce and permit inspection and copying of designated records or tangible things, with respect to receivership property or any other matter that may affect administration of the receivership;

(8) Engage a professional as provided in Section 15;

(9) Apply to a court of another state for appointment as ancillary receiver with respect to receivership property located in that state; and

(10) Exercise any power conferred by court order, this Act, or law of this State other than this Act.

With court approval, a receiver may:

(1) Except as otherwise provided in subsection 12(a)(4), incur debt for the use or benefit of receivership property other than in the ordinary course of business provided that any lien securing such indebtedness is junior to any existing liens on the receivership property, unless otherwise authorized by the law of this State other than this Act;

(2) Make improvements to receivership property;

(3) Use, sell, lease, or transfer receivership property other than in the ordinary course of business as provided in Section 16 and execute in the owner’s name any documents, conveyances, and consents as may be required for such use, sale, lease, or transfer;

(4) Assume or reject an executory contract of the owner as provided in Section 17;

(5) Pay compensation to the receiver as provided in Section 21, and to each professional engaged by the receiver as provided in Section 15;

(6) Recommend allowance or disallowance of a claim of a creditor as provided in Section 20;

(7) Make a distribution of receivership property as provided in Section 20;

(8) settle or release any rights, claims, causes of action, or defenses or the owner asserted in subsection 12(a)(5); and

(9) Abandon to the owner any receivership property that is burdensome or is not of material value to the receivership.

Q. What are the duties of a Receiver?

A. A Receiver shall:

(1) Prepare and retain appropriate business records from the receiver’s appointment until the receiver’s discharge, including a record of each receipt, disbursement, and disposition of receivership property;

(2) Account for receivership property, including the proceeds of a sale, lease, license, exchange, collection, or other disposition of the property;

(3) Promptly file or record, as applicable, with the county recorder’s office in the county where the real property is located, a notice of the receivership setting forth the name of the receiver, the owner of the real property, the title of the action, a legal description of the real property, if any, and a copy of the order appointing the receiver;

(4) Disclose to the court any fact arising during the receivership which would disqualify the receiver under Section 7; and

(5) Perform any duty imposed by court order, this Act, or law of this State other than this Act.

The recording of the notice of the receivership set forth in subsection 12(c) shall constitute constructive notice of the receivership to every person subsequently acquiring an interest in or a lien on the real property affected thereby.

A subordination agreement is enforceable to the same extent that it is enforceable under the law of this State other than this Act.

The powers and duties of a receiver may be expanded, modified, or limited by court order.

Q. What are the duties of Owner?

A. An Owner shall:

(1) Assist and cooperate with the receiver in the administration of the receivership and the discharge of the receiver’s duties;

(2) Preserve and turn over to the receiver all receivership property in the owner’s possession, custody, or control;

(3) Identify all records and other information relating to the receivership property, including a password, authorization, or other information needed to obtain or maintain access to or control of the receivership property, and make available to the receiver the records and information in the owner’s possession, custody, or control;

(4) On subpoena, submit to examination under oath by the receiver concerning the acts, conduct, property, liabilities, and financial condition of the owner or any matter relating to the receivership property or the receivership; and

(5) Perform any duty imposed by court order, this Act, or law of this State other than this Act.

Q. How much time does an Owner have to comply with the order appointing a Receiver?

A. Unless the court orders otherwise, the Owner shall file with the court and provide the receiver within 14 days of the receiver’s appointment:

(1) A list of all receivership property and exempt property of the owner, identifying:

(A) The location of the property, including the legal description of any real property;

(B) A description of all liens to which the property is subject; and

(C) The estimated value of the property.

(2) A list of all creditors, taxing authorities, and regulatory authorities having claims against the owner:

(A) Their mailing addresses;

(B) The amount and nature of their respective claims as of the date of the receiver’s appointment;

(C) Whether the claims are secured by liens; and

(D) Whether the claims are disputed.

Q. What if an Owner is a Person other than an individual?

A. If an Owner is a Person other than an individual, this Act applies to each officer, director, manager, member, partner, trustee, or other person exercising or having the power to exercise control over the affairs of the owner.

Q. What if the Owner does not cooperate?

A. If a Person knowingly fails to perform a duty imposed by this Act, the court may: (1) Award the receiver actual damages caused by the person’s failure, reasonable attorney’s fees, and costs; (2) Sanction the failure as civil contempt; and (3) Impose other equitable remedies, including an injunction or constructive trust to address a person’s failure to comply with a duty under this Act.

Q. Does an order appointing a Receiver operates as a stay?

A. Except as otherwise ordered by the court, an order appointing a receiver operates as a stay, applicable to all persons, of an act, action, or proceeding: (1) To obtain possession of, exercise control over, or enforce a judgment against receivership property; and (2) To enforce a lien against receivership property to the extent the lien secures a claim against the owner which arose before entry of the order. In addition to any stay provided in this Section, the court may enjoin an act, action, or proceeding against or relating to receivership property, the owner, or the receiver if the injunction is necessary to protect the receivership property or facilitate administration of the receivership. A person whose act, action, or proceeding is stayed or enjoined under this Section may apply to the court for relief from the stay or injunction for cause, including lack of adequate protection.

Q. When an order appointing a Receiver does not operate as a stay?

A. An order appointing a Receiver does not operate as a stay or injunction of:

(1) An act, action, or proceeding to perfect, or maintain or continue the perfection of, an interest in receivership property, provided that if perfection of an interest would require seizure of receivership property or commencement of an action, the perfection shall instead be accomplished by filing with the court, and by serving upon the receiver, notice of the interest within the time fixed by law for seizure or commencement;

(2) Commencement or continuation of a criminal proceeding;

(3) Commencement or continuation of an action or proceeding, or enforcement of a judgment other than a money judgment in an action or proceeding, by a governmental unit to enforce its police or regulatory power;

(4) Establishment by a governmental unit of a tax liability against the owner or receivership property or an appeal of the liability; or

(5) The exercise of rights of a party to a swap agreement, securities contract, repurchase agreement, commodity contract, forward contract, or master netting agreement, as those terms are defined in the federal Bankruptcy Code, to the extent that a court would not have the power to stay the exercise if the owner were a debtor under the Bankruptcy Code.

Q. What happens when a stay or injunction is violated?

A. The court may void an act that violates a stay or injunction under this Act. If a person knowingly violates a stay or injunction under this Act, the court may: (1) Award actual damages caused by the violation, reasonable attorney’s fees, and costs; and (2) Sanction the violation as civil contempt.

Q. Can a Receiver engage and compensate other professionals?

A. With court approval, a Receiver may engage one or more attorneys, accountants, appraisers, auctioneers, brokers, or other professionals to assist the receiver in performing a duty or exercising a power of the receiver. The court may authorize the receiver’s engagement of professionals on any reasonable terms and conditions of employment, including on a retainer, on an hourly basis, on a fixed or percentage fee basis, on a contingent fee basis or a combination of the foregoing. In connection with the proposed engagement of a professional, the receiver shall disclose to the court:

(1) The identity and qualifications of the professional;

(2) The scope and nature of the proposed engagement;

(3) Any potential conflict of interest; and

(4) The proposed compensation.

Q. Can a Receiver use or transfer the Receivership Property?

A. With court approval, a Receiver may use receivership property other than in the ordinary course of business. With court approval, a receiver may transfer receivership property other than in the ordinary course of business by sale, lease, license, exchange, or other disposition. Unless the agreement of sale provides otherwise, a sale under this Section is free and clear of a lien of the person that obtained appointment of the receiver, any subordinate lien, and any right of redemption. However, unless the holder of a senior lien consents, such a sale:

(1) Is subject to the senior lien and to the rights and remedies of the holder of the senior lien under law other than this Act; and

(2) Does not affect the obligation secured by the senior lien.

A lien on receivership property which is extinguished by a transfer under subsection 16(c) attaches to the proceeds of the transfer with the same validity, perfection, and priority the lien had on the property immediately before the transfer, even if the proceeds are not sufficient to satisfy all obligations secured by the lien.

A transfer under subsection 16(c) may occur by means other than a public auction sale. A creditor holding a valid lien on the property to be transferred may purchase the property and offset against the purchase price part or all of the allowed amount secured by the lien, if the creditor tenders funds sufficient to satisfy in full the reasonable expenses of transfer and the obligation secured by any senior lien extinguished by the transfer.

A reversal or modification of an order approving a transfer under subsection 16(c) does not affect the validity of the transfer to a person that acquired the property in good faith or revive against the person any lien extinguished by the transfer, whether the person knew before the transfer of the request for reversal or modification, unless the court stayed the order before the transfer.

Q. Can a Receiver assume or reject an executor contract of the owner relating to receivership property?

A. With court approval, a Receiver may assume or reject an executor contract of the owner relating to receivership property. An executory contract may only be assumed or rejected by court order. The court may condition the receiver’s assumption and continued performance of the executory contract on terms appropriate under the circumstances. If the receiver does not obtain court approval to assume or reject the executor contract by the termination of receivership, the receiver is deemed to have rejected the executory contract. At the request of the non-owner party to the executory contract, a court may set a reasonable time after the receiver’s appointment to assume or reject an executory contract.

A receiver’s performance of an executory contract before court approval under subsection 17(b) of its assumption or rejection is not an assumption of the contract and does not preclude the receiver from seeking approval to reject the contract.

A provision in an executory contract which requires or permits a forfeiture, modification, or termination of the contract because of the appointment of a receiver or the financial condition of the owner does not affect a receiver’s power under subsection 17(b) to assume the contract.

A receiver’s right to possess or use receivership property pursuant to an executory contract terminates upon rejection of the contract under subsection 17(b). Rejection of an executory contract constitutes a breach of the executor contract effective immediately before appointment of the receiver. A claim for damages for rejection of the contract shall be presented or filed in the same manner as other claims in the receivership no later than:

(1) The time set for submitting a claim in the receivership; or

(2) 30 days after the court approves the rejection.

If, at the time a receiver is appointed, the owner has the right to assign an executory contract relating to receivership property under law of this State other than this

Act, the receiver may assign the contract with court approval and subject to the terms of the contract.

If a receiver rejects under subsection 17(b) an executory contract for the sale of receivership property that is real property in possession of the purchaser or a real-property timeshare interest, the purchaser may:

(1) Treat the rejection as a termination of the contract, and in that case the purchaser has a lien on the property for the recovery of any part of the purchase price the purchaser paid; or

(2) Retain the purchaser’s right to possession under the contract, and in that case the purchaser shall continue to perform all obligations arising under the contract and may offset any damages caused by nonperformance of an obligation of the owner after the date of the rejection, but the purchaser has no right or claim against other receivership property or the receiver on account of the damages.

Q. Can a Receiver reject unexpired leases of real property?

A. A Receiver may not reject an unexpired lease of real property under which the owner is the landlord if:

(1) The tenant occupies the leased premises as the tenant’s primary residence;

(2) The receiver was appointed at the request of a person other than a mortgagee; or

(3) The receiver was appointed at the request of a mortgagee and:

(A) The lease is superior to the lien of the mortgage;

(B) The tenant has an enforceable agreement with the mortgagee or the holder of a senior lien under which the tenant’s occupancy will not be disturbed as long as the tenant performs its obligations under the lease;

(C) The mortgagee has consented to the lease, either in a signed record or by its failure timely to object that the lease violated the mortgage; or

(D) The terms of the lease were commercially reasonable at the time the lease was agreed to and the tenant did not know or have reason to know that the lease violated the mortgage.

Q. What are defenses and immunities of Receiver?

A. A receiver is entitled to all defenses and immunities provided by law of this State for an act or omission within the scope of the receiver’s appointment. Approval of the court that appointed the receiver must be obtained before the commencement of an action or proceeding against the receiver or a professional engaged by the receiver regarding an act or omission in administering receivership property. A party or party in interest may conduct discovery of the receiver concerning any matter relating to the receiver’s administration of the receivership property after obtaining an order authorizing the discovery.

Q. Does a Receiver have to file reports with a court?

A. A receiver may file or, if ordered by the court, shall file an interim report that includes:

(1) The dates covered by the interim report;

(2) The activities of the receiver since appointment or a previous report;

(3) Receipts and disbursements, including a payment made or proposed to be made to a professional engaged by the receiver;

(4) Receipts and dispositions of receivership property;

(5) Fees and expenses of the receiver and, if not filed separately, a request for approval of payment of the fees and expenses; and

(6) Any other information required by the court.

Unless excused by the court, on completion of a receiver’s duties, the receiver shall file a motion seeking approval of a final report and termination of the court’s administration of the receivership property.

The final report shall include:

(1) A description of the activities of the receiver in the conduct of the receivership;

(2) A list of receivership property at the commencement of the receivership and any receivership property received during the receivership;

(3) A list of disbursements, including payments to professionals engaged by the receiver;

(4) A list of dispositions of receivership property;

(5) A list of distributions made or proposed to be made from the receivership for creditor claims;

(6) If not filed separately, a request for approval of the payment of fees and expenses of the receiver and the receiver’s professionals; and

(7) Any other information required by the court.

If the court approves a final report filed under subsection 23(a) and the receiver distributes all receivership property, the receiver is discharged and the court’s administration of the receivership property is terminated. The order approving a final report and termination of the receivership shall include such additional terms as the court deems appropriate.

Q. Does a Receiver have give notice of appointment of the receiver to all creditors of the owner?

A. A receiver shall give notice of appointment of the receiver to all creditors of the owner by: (1) Deposit for delivery through first-class mail or other commercially reasonable delivery method to the last-known address of each creditor; and (2) Such other means as directed by the court.

Q. What does notice of appointment of the receiver to all creditors must contain?

A. The notice required by subsection 20(a) must specify the date by which each creditor holding a claim against the owner which arose before appointment of the receiver must file the claim with the court. The date specified must be at least 60 days after the date of the notice under subsection 20(a).

Q. What happens if a creditor does not file a claim?

A. Unless the court orders otherwise, a claim that is not timely filed with the court is not entitled to a distribution from the receivership.

Q. What should creditor’s claim include?

A. A claim filed by a creditor under this Act shall be titled “Proof of Claim” and must:

(1) State the name and address of the creditor;

(2) State the amount and basis of the claim;

(3) Identify any property securing the claim;

(4) Be signed by the creditor or an authorized agent under penalty of perjury; and

(5) Include a copy of any record on which the claim is based.

Q. Can a creditor assign his/her/its claim?

A. An assignment by a creditor of a claim against the owner or receivership is effective against the receiver only if the assignee gives timely notice of the assignment to the receiver in a signed record prior to the entry of an order approving a receiver’s final report.

Q. What happens when a creditor timely files a Proof of Claim?

A. A claim filed with the court in accordance with subsections 20(b) and 20(c) constitutes prima facie evidence of the validity and amount of the claim. At any time before entry of an order approving a receiver’s final report, the receiver or other person with an interest in the receivership may file with the court an objection to a claim of a creditor, stating the basis for the objection. The court shall allow or disallow the claim according to the law of this State other than this Act.

Q. What happens when receivership property is likely to be insufficient to satisfy claims of each creditor?

A. If the court concludes that receivership property is likely to be insufficient to satisfy claims of each creditor holding a perfected lien on the property, the court may order that: (1) The receiver need not give notice under subsection 20(a) of the appointment to all creditors of the owner, but only such creditors as the court directs; and (2) Unsecured creditors need not submit claims under this Section.

Q. How is receivership property distributed to creditors?

A. A distribution of receivership property to a creditor holding a perfected lien on the property must be made in accordance with the creditor’s priority under law of this State other than this Act. A distribution of receivership property to a creditor with an allowed unsecured claim must be made as the court directs on a pro rata basis according to law of this State other than this Act; and if all of the creditors holding claims have been paid in full, any residue shall be paid to the owner.

Q. How is a Receiver paid?

A. The court may award a receiver from receivership property the reasonable and necessary fees and expenses of performing the duties of the receiver and exercising the powers of the receiver. The court may order one or more of the following to pay the reasonable and necessary fees and expenses of the receivership, including reasonable attorney’s fees and costs: (1) A person that requested the appointment of the receiver, if the receivership does not produce sufficient funds to pay the fees and expenses; or (2) A person whose conduct justified or would have justified the appointment of the receiver under Section 6(a)(1) or 6(a)(3)(D).

Q. Can a Receiver be removed, replaced, or receivership terminated?

A. The court may remove a receiver for cause. The court shall replace a receiver that dies, resigns, or is removed. If the court finds that a receiver that resigns or is removed, or the representative of a receiver that is deceased, has accounted fully for and turned over to the successor receiver all receivership property and has filed a report of all receipts and disbursements during the service of the replaced receiver, the replaced receiver is discharged. The court may discharge a receiver and terminate the court’s administration of the receivership property if the court finds that appointment of the receiver was improvident or that the circumstances no longer warrant continuation of the receivership. If the court finds that the appointment was sought wrongfully or in bad faith, the court may assess against the person that sought the appointment: (1) The fees and expenses of the receivership, including reasonable attorney’s fees and costs; and (2) Actual damages caused by the appointment, including reasonable attorney’s fees and costs.

Q. How Receivers from other states can perform their duties in respect to property located in Illinois?

A. The court may appoint a foreign receiver as an ancillary receiver with respect to property located in this State or subject to the jurisdiction of the court for which a receiver could be appointed under this Act, if:

(1) The person would be eligible to serve as receiver under Section 7 of this Act; and

(2) The appointment furthers the person’s possession, custody, control, or disposition of property subject to the receivership in the other state.

(3) The appointment is authorized by the court that appointed the foreign receiver.

The court may issue an order that gives effect to an order entered in another state appointing or directing a receiver. Unless the court orders otherwise, an ancillary receiver appointed under subsection 24(a) has the rights, powers, duties and obligations of a receiver appointed under this Act.

Q. Does the Illinois Receivership Act apply to Receivers appointed prior to the effective date of this Act?

A. The Illinois Receivership Act does not apply to a receivership for which the receiver was appointed before the effective date of this Act.

Alignment with the Illinois Receivership Act

Receivership is a complex legal area that requires expertise in many fields. If you find yourself in need of a receiver, contact Arthur R. van der Vant, the Illinois Receiver at 312-607-4646, or email vandervant@IllinoisReceiver.com

The Illinois Receivership Act introduces procedural consistency, due process safeguards, and clearly defined responsibilities. Appointing a professional like Arthur R. van der Vant ensures compliance with the new statutory requirements while delivering the experience and judgment critical to navigating this evolving legal landscape.

Why Choose Illinois Receiver?

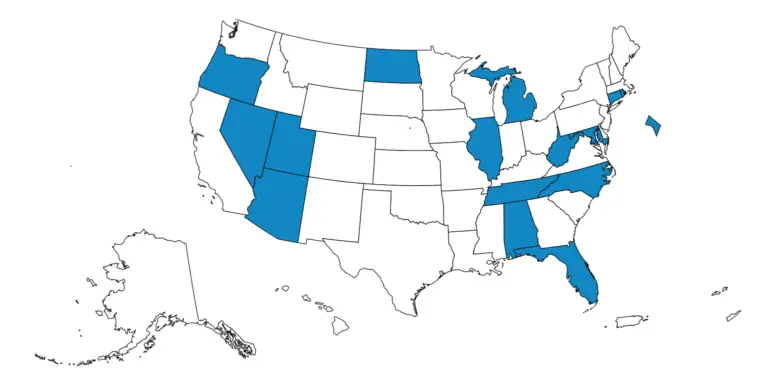

Extensive Expertise: Arthur R. van der Vant brings more than 37 years of experience in real estate, property management, and receivership services. He has served as a court-appointed receiver in both Illinois state and federal courts. His credentials include the prestigious CCIM designation in commercial and investment real estate, and the CAI designation in asset liquidation—both equivalent to Ph.D.-level education—demonstrating deep expertise and practical proficiency.

Track Record of Success: Trusted by major institutions such as the FDIC, MB Financial Bank, and Freedom Title, Illinois Receiver has a proven history of managing complex and high-value receivership cases with consistently strong results.

Comprehensive Services: Illinois Receiver offers a full suite of services, including asset protection, sales, property maintenance, and tenant management—delivering customized, end-to-end solutions for every case.

Rapid Response: The team is equipped to mobilize within 24 hours, ensuring swift action to protect and preserve the value of assets.

Transparent, Fair Pricing: Services are billed in 1/10-hour increments, providing clients with clear, cost-effective pricing while maintaining the highest standards of service.

Contact

Arthur R. van der Vant Illinois Receiver 312-607-4646 vandervant@IllinoisReceiver.com IllinoisReceiver.com