The introduction of House Bill HB0028, which establishes the Illinois Receivership Act, is a pivotal moment for the state’s commercial real estate and legal sectors. Presented by Rep. Daniel Didech during the 104th General Assembly (2025-2026), this bill aims to create a structured and modern framework for managing distressed properties through receiverships. Its passage will bring essential benefits not only to the receivership process but to Illinois’ broader real estate and business community.

What is HB0028 and Why is It Important?

At its core, HB0028 seeks to formalize and streamline the receivership process in Illinois. Receiverships play a critical role when properties are in foreclosure or facing financial distress, ensuring that assets are properly managed, preserved, and ultimately maximized for the benefit of creditors and stakeholders. Currently, the process varies from jurisdiction to jurisdiction and often lacks clear, consistent guidelines for managing complex assets. HB0028 addresses this gap by establishing an Illinois Receivership Act that will provide clarity, efficiency, and legal certainty for receivers, property owners, and the courts.

The bill proposes a comprehensive approach to receiverships, including the following key components:

- Defined Legal Standards: HB0028 would set out clear and standardized procedures for appointing receivers, managing properties, and ensuring compliance with legal obligations.

- Property Management Guidelines: It will establish clear expectations for receivers managing various property types, from industrial and office spaces to residential and special-use buildings.

- Strengthening Court Involvement: The bill emphasizes the need for receivers to report regularly to the courts, ensuring ongoing oversight and maintaining transparency throughout the receivership process.

The Benefits to the Industry

1. Enhanced Efficiency and Predictability

For stakeholders, including lenders, property owners, and investors, HB0028 will provide a more predictable and efficient process for managing distressed properties. Currently, without a uniform set of guidelines, each receivership can be subject to different interpretations and procedural variances across Illinois. By establishing a clear set of standards, the bill will streamline operations, reduce delays, and ensure consistency in the management of assets.

2. Increased Property Value Preservation

One of the most significant advantages of a formalized receivership process is the protection of property value. Distressed assets often suffer from neglect or poor management during the foreclosure process. By appointing qualified receivers with standardized protocols, the bill ensures that properties are maintained, marketed, and leased effectively to preserve their value. This is especially critical in sectors like commercial real estate, where the failure to properly manage properties can lead to significant loss in asset value.

3. Greater Clarity for Stakeholders

For legal professionals, lenders, and property managers, HB0028 will provide clarity on their roles and responsibilities within the receivership process. It outlines procedures for everything from initial property assessment to lease negotiations, allowing for a more collaborative and coordinated effort to resolve distressed asset situations. This clarity benefits both creditors and property owners by providing a fair and structured framework in which everyone understands their rights and obligations.

4. Boosting Investor Confidence

For investors, both local and national, the establishment of a clear receivership process increases confidence in Illinois’ real estate market. With standardized procedures in place, investors can feel more secure knowing that their interests will be properly managed during times of distress. This heightened confidence can lead to increased investment in Illinois’ commercial real estate market, which benefits the state economy and fosters growth in key industries.

5. Supporting Job Creation and Economic Growth

As the receivership process is more efficiently managed, the potential for property redevelopment and revitalization increases. The bill’s structure encourages the development of turnaround strategies and tenant acquisition programs, leading to the successful reintegration of distressed properties into the market. This, in turn, leads to job creation, especially in construction, property management, and leasing sectors, contributing to economic growth throughout Illinois.

Why HB0028 Needs Your Support

The introduction of HB0028 is an important step toward modernizing Illinois’ approach to receiverships. As the commercial real estate and legal industries continue to evolve, it is essential that the state adapts its framework to meet the needs of a dynamic market. By supporting the adoption of this bill, stakeholders across the industry can ensure that Illinois remains a competitive and business-friendly environment for investment, development, and property management.

With its focus on efficiency, clarity, and value preservation, HB0028 provides a path forward for the successful management of distressed properties. It is a critical step for Illinois in creating a stable, transparent, and predictable environment that benefits property owners, tenants, investors, and the broader community.

HB0028 and the Illinois Justice System

The adoption of HB0028 would bring several key benefits to the justice system, particularly in how the courts handle receiverships and distressed property cases. Here are some specific advantages:

1. Streamlined Case Management

HB0028 establishes clear, standardized procedures for the appointment and management of receivers, which would help reduce delays and inefficiencies in the court system. By outlining specific processes for managing distressed properties, from asset preservation to property disposition, courts would have a clearer framework to follow, resulting in faster decision-making and a more efficient judicial process.

This streamlining would reduce the court’s workload in receivership cases, freeing up resources and reducing the time spent on each individual case. The outcome is a more efficient system that helps the courts process other cases more quickly, contributing to the overall efficiency of the judicial system.

2. Increased Transparency and Accountability

Under HB0028, receivers would be required to file detailed reports with the court regularly, keeping judges informed on the status of the properties under their control. This increased reporting helps maintain transparency throughout the receivership process, ensuring that the court can quickly identify any issues or conflicts. With better oversight, the risk of mismanagement or abuse of the receivership process is minimized, leading to greater accountability for the receivers and better outcomes for all parties involved.

3. Consistency in Decision-Making

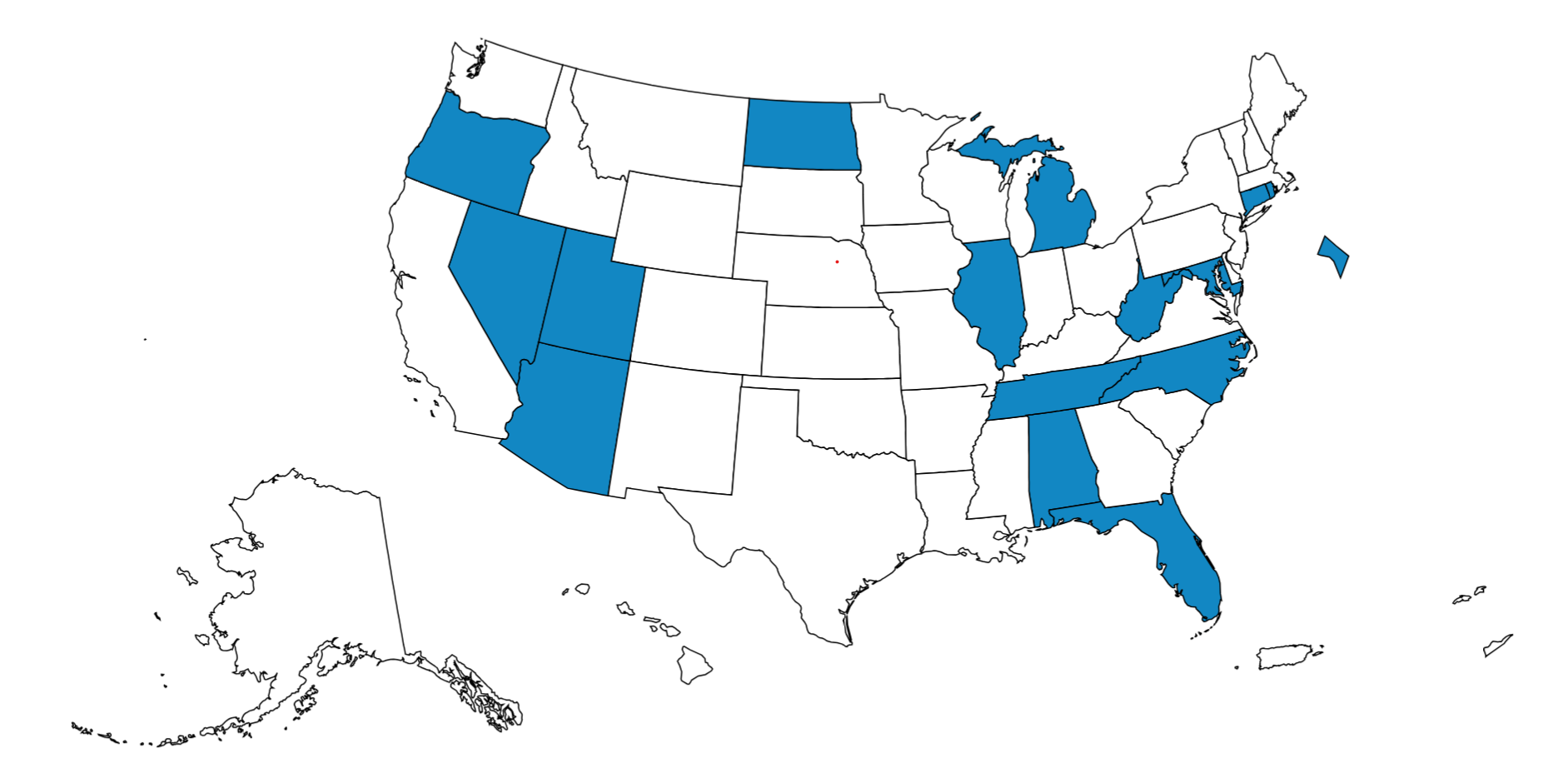

HB0028 would standardize how receiverships are handled across the state of Illinois, ensuring consistent decision-making. Courts will no longer be burdened with having to navigate varying practices or interpretations of the law from one district to another. This consistency helps judges apply the law more effectively and equitably across different jurisdictions, providing a uniform experience for all involved.

With standardized guidelines, courts can more confidently issue rulings, reducing the likelihood of lengthy delays due to legal uncertainties or disputes over procedural questions.

4. Enhanced Legal Clarity

For judges, attorneys, and other legal professionals, HB0028 offers a clear legal framework for handling receivership cases. This clarity allows for more effective case preparation, reducing confusion and errors in legal filings. With a clear structure in place, the courts will have better access to well-organized legal documents and motions, making the judicial process smoother and more predictable.

Moreover, the bill will likely reduce litigation and disputes over procedural matters, as the law will be more clearly defined and understood, helping avoid unnecessary legal conflicts that can prolong cases.

5. Reduced Burden on the Courts in Foreclosure Cases

Receiverships often arise in the context of foreclosures, which are already complex and time-consuming for the courts. By providing a formalized structure for handling receivership cases, HB0028 will allow judges to focus on the legal aspects of foreclosure, knowing that the property management and asset preservation are being handled by qualified receivers according to a set process.

This division of labor reduces the burden on courts, ensuring that foreclosure cases can be handled more effectively and with less judicial intervention required. As a result, the court system can devote its resources to other pressing matters, further improving efficiency.

6. Fostering Public Trust in the Judicial Process

The more transparent, consistent, and streamlined the court’s handling of receiverships, the more the public can trust the judicial system. By adopting HB0028, Illinois would send a clear message that it is committed to a fair, efficient, and effective legal framework for distressed property cases. This will not only benefit parties directly involved in receiverships but will also enhance public confidence in the ability of the courts to handle complex real estate and foreclosure matters.

Conclusion

The adoption of HB0028, the Illinois Receivership Act, would significantly benefit the judicial system by streamlining the receivership process, ensuring transparency, enhancing accountability, and creating consistency in decision-making. These improvements would help courts manage complex real estate cases more efficiently, reducing delays and contributing to the overall effectiveness of the justice system.

In the long run, HB0028 would reduce the workload of judges and court staff, minimize procedural disputes, and increase public trust in the courts’ ability to handle receivership cases. As such, the bill offers a win-win scenario for both the legal system and the stakeholders involved in distressed property management.

By: Arthur R. van der Vant, Illinois Receiver

For more information contact:

Arthur R. van der Vant Illinois Receiver https://illinoisreceiver.com 5401 W. Lawrence Ave. #300813 Chicago, IL 60630 Tel. 1(312) 607-4646 Email: vandervant@illinoisreceiver.com