Introduction

Receivership, as a legal remedy, has evolved substantially over the centuries. Originating from the equitable jurisdiction of the English Court of Chancery, receivership has matured into a complex and flexible tool used across a wide range of commercial and insolvency contexts. This article traces the historical development of receiverships from their origins in English common law to the present-day statutory codification in Illinois.

I. Origins and Early Development

In late medieval England, the concept of receivership emerged as a response to the complexities of estate management and the need for effective financial oversight. The term “receiver” referred to an official appointed to manage and administer the revenues of an estate or lordship. This role was particularly significant in the context of large estates, where centralized management was essential for maintaining control over resources and ensuring the proper collection of rents and dues.

The roots of receivership can be traced to the administrative practices of the Anglo-Saxon period, where officials such as reeves were responsible for overseeing estate operations. With the Norman Conquest in 1066, the feudal system introduced more structured and hierarchical forms of land tenure and administration. Under this system, lords granted lands to vassals in exchange for military service, and the management of these lands often required appointed officials to oversee their operation and ensure the collection of revenues.

II. Institutionalization in the 13th and 14th Centuries

By the 13th century, the role of the receiver had become more institutionalized, particularly in the context of royal and ecclesiastical estates. For instance, in the lordship of Glamorgan, the administration of estates was organized under a centralized receivership system. Receivers were responsible for managing the revenues of multiple estates, coordinating the activities of local officials, and ensuring the proper accounting of income and expenditures. This centralized approach allowed for more efficient management and reduced the potential for mismanagement or fraud

Similarly, in the city of Exeter, the position of receiver general was established to oversee the collection of rents and revenues. The receiver’s duties included managing the city’s finances, overseeing public works, and ensuring the proper allocation of resources. This role was considered one of the highest civic offices, reflecting the importance of financial oversight in urban administration. Records from the 14th century provide detailed accounts of the receiver’s activities, offering valuable insights into medieval urban governance.

III. The Role of the Court of Chancery

The Court of Chancery, established in the 14th century, played a pivotal role in the development of receivership practices. Initially serving as an administrative body to handle the King’s conscience and equitable matters, the Court of Chancery gradually became a central institution in the administration of justice. It had jurisdiction over cases involving trusts, land law, and the estates of lunatics and minors. In these contexts, the court often appointed receivers to manage the estates of individuals who were unable to do so themselves due to legal incapacity. The receiver acted as a fiduciary, ensuring that the estate was managed in the best interests of the beneficiary. This practice laid the groundwork for modern receivership procedures.

IV. Expansion and Formalization

During the 16th century, the role of the receiver expanded and became more formalized, particularly with the establishment of specialized courts such as the Court of Augmentations and the Court of Wards and Liveries. The Court of Augmentations, created in 1536, was responsible for managing the revenues from monastic lands seized during the dissolution of the monasteries. It employed receivers to oversee the administration of these estates, ensuring the efficient collection of rents and the proper management of properties.

Similarly, the Court of Wards and Liveries, established in 1540, was tasked with administering the estates of minors who inherited land. The court appointed receivers to manage these estates until the heirs came of age, ensuring that the properties were properly maintained and that revenues were collected in accordance with feudal obligations.

V. Legacy and Influence

The practices developed during the late medieval period laid the foundation for modern receivership procedures. The emphasis on fiduciary responsibility, detailed record-keeping, and centralized management of estates influenced the development of legal frameworks governing receiverships in subsequent centuries. These medieval practices underscored the importance of effective financial oversight and the role of appointed officials in maintaining the stability and integrity of estate management.

VI. Expansion in the 19th Century

By the 19th century, the Industrial Revolution and expanding commerce necessitated a broader application of receivership. Courts increasingly appointed receivers in insolvency and corporate contexts. They became particularly useful during insolvencies, where preserving large, complex enterprises as going concerns required more than piecemeal liquidation.

This period also saw the rise of the “receiver and manager”—a hybrid role allowing for active management of businesses rather than mere custodianship of assets. This shift foreshadowed modern concepts of business rescue and reorganization.

VII. Reception in the United States

The U.S. legal system, inheriting the common law tradition, adopted and adapted receivership practices to fit its federalist structure. American courts, particularly in equity, utilized receiverships in mortgage foreclosures, insolvency proceedings, and disputes over trusts and corporate control.

Federal receiverships grew prominent in the 19th and early 20th centuries, particularly during railroad reorganizations. Later, the concept was further extended in securities regulation and bank failures. At the state level, receivership practices varied widely, with some states codifying procedures while others relied on judicial discretion.

VIII. The Uniform Commercial Real Estate Receivership Act (UCRERA)

At the state level, however, receivership practices evolved in a fragmented manner. Some states developed codified procedures for appointing and overseeing receivers, while others left receivership to the discretion of judges applying equitable principles. This patchwork of legal standards created uncertainty and inefficiency—especially in multistate or commercial real estate cases.

In response to the lack of consistency in receivership law across U.S. jurisdictions, the Uniform Law Commission (ULC) drafted the Uniform Commercial Real Estate Receivership Act (UCRERA) in 2015. The purpose of UCRERA is to establish a comprehensive, standardized legal framework for the appointment, as well as duties and powers of receivers.

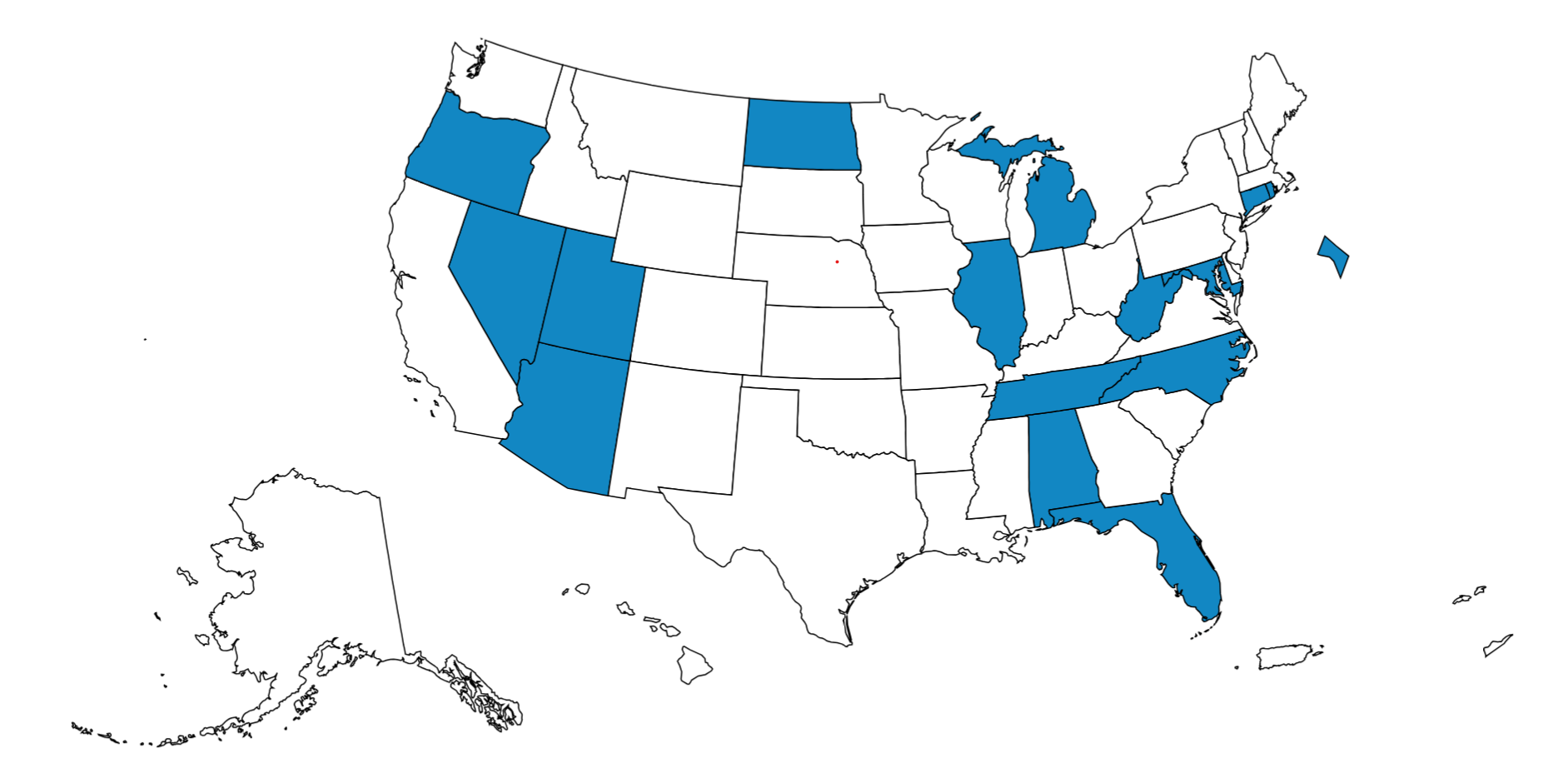

UCRERA or a version thereof has already been adopted in 14 states, including Alabama, Arizona, Connecticut, District of Columbia, Florida, Maryland, Michigan, Nevada, North Carolina, Oregon, Rhode Island, Tennessee, Utah, and West Virginia. It serves as a model law for states that seek to modernize and harmonize their receivership statutes. In addition to the above states, recently North Dakota and Illinois have also passed their receivership acts, which are waiting to take effect.

IX. The Illinois Receivership Act (HB0028)

Illinois, recognizing the need for a modernized and standardized approach to receiverships, enacted the Illinois Receivership Act (HB0028). This legislation provides a comprehensive framework for the appointment and operation of receivers in the state.

The Illinois Receivership Act establishes a clear process for the court to appoint a receiver, outlining the receiver’s powers and duties, including the authority to take possession of, manage, and dispose of receivership property. The Act applies to various types of property, including real property, personal property related to real property, and business assets such as corporations and trusts. However, it does not apply to certain residential properties or receivers appointed under the Illinois Mortgage Foreclosure Law.

By codifying the receivership process, the Illinois Receivership Act aims to provide a more predictable and efficient system for managing distressed properties, balancing the interests of property owners, creditors, and other stakeholders.

Conclusion

The evolution of receiverships from their origins in the English Court of Chancery to the enactment of the Illinois Receivership Act reflects a continuous effort to adapt legal mechanisms to the complexities of property management and disputes. The Illinois Receivership Act represents a modern approach to an age-old legal remedy, ensuring that receiverships are conducted in a manner that is fair, transparent, and effective in addressing the challenges of contemporary property issues.

When facing distressed commercial real estate, creditors require a receiver who combines legal acumen with operational expertise. Arthur R. van der Vant, the Illinois Receiver stands out as a seasoned Illinois court-appointed receiver, offering a unique blend of experience, professionalism, and efficiency. Entrust your receivership matters to a professional who understands the intricacies of Illinois law and is dedicated to achieving optimal outcomes for creditors. Choose Arthur R. van der Vant for reliable, expert receivership services.

Contact Information

To discuss your receivership needs or to appoint Arthur R. van der Vant, please contact:

Phone: (312) 607-4646 Email: vandervant@illinoisreceiver.com Website: illinoisreceiver.com