A diverse portfolio of rental properties can bring many benefits to landlords and property managers. It can help to spread risk, increase income, and provide a hedge against market fluctuations.

Here are a few benefits of having a diverse portfolio of rental properties:

- 💰 Spread risk: By diversifying across different types of properties and geographic locations, you can spread your risk and be less vulnerable to market fluctuations.

- 🏘️ Increase income: A diverse portfolio can increase your income by providing a steady stream of rental income from different properties.

- 🔍 Hedge against market fluctuations: A diverse portfolio can provide a hedge against market fluctuations, by allowing you to invest in different types of properties and different markets.

- 💼 Maximize returns: By diversifying your portfolio, you can maximize your returns by investing in properties with higher yields or better growth prospects.

- 🏠 Diversify your tenant base: A diverse portfolio can also diversify your tenant base and reduce the risk of having all your eggs in one basket.

Remember, by having a diverse portfolio of rental properties, you can spread your risk, increase your income, and provide a hedge against market fluctuations.

If you’re looking for more tips and strategies for building and maintaining a diverse portfolio of rental properties, shoot me a message! 💬

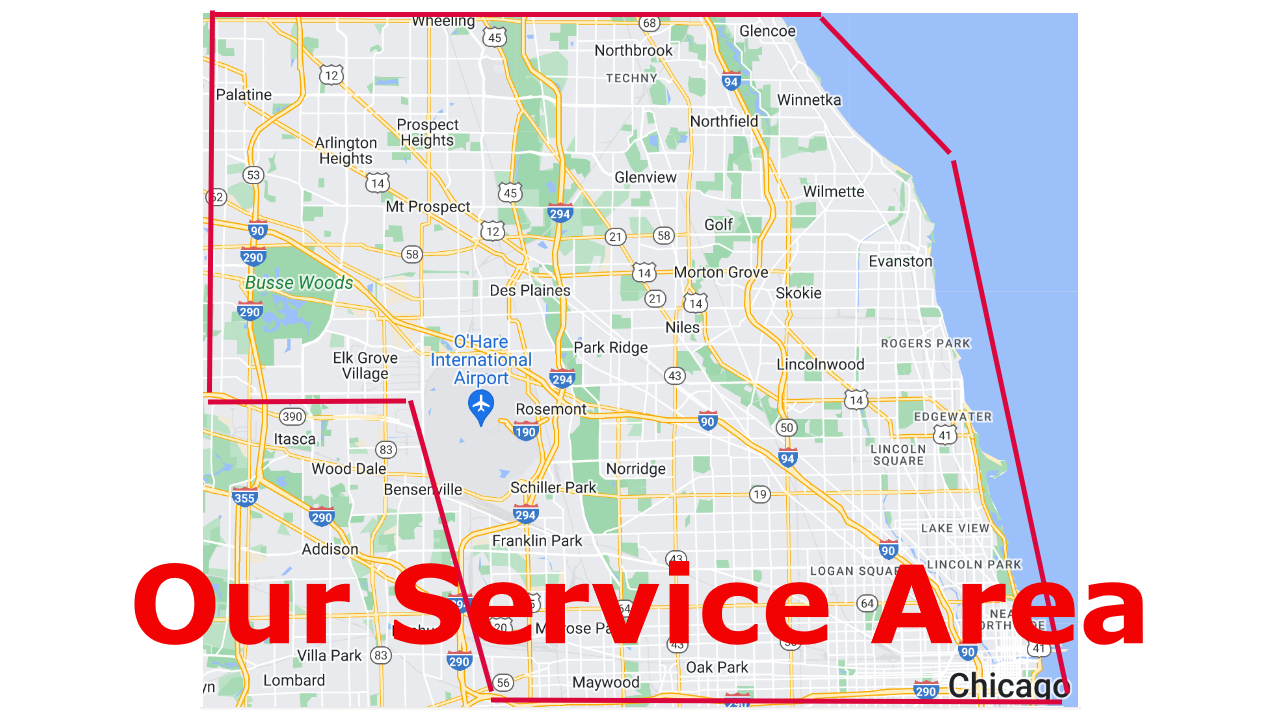

Follow #illinoisreceiver on LinkedIn to create opportunities together!

Subscribe to Effective Property Management Newsletter here: https://www.linkedin.com/newsletters/effective-property-management-7017549896136187904/