Commercial real estate (CRE) workouts have undergone significant changes in Illinois from 2008 to 2025. The economic backdrop, legal frameworks, market trends, and technological advances have all contributed to this evolution. To understand how CRE workouts have transformed, it’s necessary to break down key phases, including the aftermath of the 2008 financial crisis, the recovery period, the COVID-19 pandemic’s impact, and the ongoing post-pandemic restructuring efforts that have shaped CRE workouts today.

The 2008 Financial Crisis and the Initial Shift (2008 – 2012)

The global financial crisis of 2007-2008 had profound effects on commercial real estate markets across the United States, including Illinois. As banks failed and credit markets froze, the commercial real estate sector experienced a sharp decline in asset values. In Illinois, especially in cities like Chicago, developers, property owners, and investors faced significant losses. Vacancies increased, property prices plummeted, and tenants struggled to make lease payments. Lenders, especially regional banks, found themselves saddled with a growing portfolio of non-performing loans (NPLs).

Key Elements of CRE Workouts in Illinois During This Period:

- Foreclosures and Default: In the wake of the crisis, there was a surge in CRE foreclosures. Borrowers who had overstretched themselves financially found themselves unable to service their debt, leading to a significant rise in distressed properties. Lenders, particularly smaller community banks, were left to navigate the challenge of liquidating or restructuring defaulted loans.

- Loan Modifications and Debt Restructuring: Workouts during this time were largely focused on negotiating loan modifications. Commercial landlords and borrowers often sought to extend the term of their loans, reduce interest rates, or alter other terms to avoid foreclosure. For many distressed properties, these modifications were crucial to providing the time necessary for market conditions to improve.

- Receiverships: Receiverships became a more common tool for managing distressed commercial properties. Lenders appointed receivers to take control of properties where the borrower was unable or unwilling to manage the property. The receiver would manage operations, secure tenants, and ensure property maintenance while the lender worked with the borrower to reach a solution.

Recovery and New Strategies (2012 – 2019)

As the U.S. economy recovered from the crisis and Illinois’ commercial real estate market began to stabilize, CRE workouts evolved to reflect changing market dynamics. Economic recovery, rising property values, and a return of institutional investors led to a period of more sophisticated workout strategies.

Key Elements of CRE Workouts in Illinois During This Period:

- Securitization of Commercial Mortgages: Post-2008, lenders in Illinois increasingly turned to commercial mortgage-backed securities (CMBS) as a financing mechanism. This made workouts more complex as the mortgages were often held by multiple investors with varying interests. Resolving distressed assets required coordination among these investors, which led to the development of more structured and formalized workout approaches.

- Loan Sales and Asset Disposition: During this recovery phase, distressed property owners often found themselves in a position where selling their assets was the best option. Lenders, seeking to minimize losses, increasingly sold distressed loans to investment firms, private equity groups, and opportunistic investors. These buyers would then take control of properties and either liquidate them or undertake a long-term investment strategy.

- REO (Real Estate Owned) Properties: As foreclosure activity slowed and markets stabilized, the focus shifted to managing and disposing of REO properties. These were properties that had been taken back by lenders through foreclosure, and the challenge was to sell them at the right price while managing the physical and financial health of these assets.

- Rise of Loan Modifications and Principal Reductions: While initial workouts in the post-crisis years focused on extending loan terms or lowering interest rates, by 2015, some lenders began to offer principal reductions. This was particularly important for properties in areas that had not fully recovered in terms of value. These principal reductions helped borrowers avoid foreclosure by making the debt load more manageable.

The COVID-19 Pandemic and the Shift to Digital Workouts (2020 – 2022)

The COVID-19 pandemic, which began in 2020, created an entirely new set of challenges for commercial real estate in Illinois. The abrupt economic shutdown led to widespread disruptions in commercial leasing, particularly in office spaces, retail, and hospitality. With tenants unable to meet rent obligations and the commercial real estate market in flux, the workout landscape shifted again.

Key Elements of CRE Workouts in Illinois During This Period:

- Government Intervention and Loan Forbearance: The federal government stepped in with the CARES Act, which offered forbearance options for commercial real estate loans, allowing borrowers to delay payments for up to 12 months. Illinois landlords and borrowers with federally-backed loans were able to temporarily defer payments, which provided critical breathing room.

- Property Type Challenges: The pandemic created specific challenges for certain property types. The retail and hospitality sectors were hit hardest, with widespread closures and reduced foot traffic. Workouts in these sectors often involved negotiating rent abatements, temporary deferrals, or even outright lease restructurings. Office buildings in urban centers like Chicago also faced significant disruptions as businesses adopted remote work, leading to long-term concerns about vacancy rates and the future of office space.

- Virtual Court Hearings and Digital Workouts: As courts closed and in-person negotiations became more difficult, the use of technology became essential. Virtual meetings, digital document sharing, and even remote Zoom court hearings became the norm. This technological shift streamlined the workout process and made it easier for stakeholders to collaborate without having to meet in person.

- Debt Restructuring and Tenant Repurposing: Commercial landlords in Illinois began to explore tenant repurposing as a solution for troubled properties. This included adjusting office space to accommodate new uses or converting underperforming retail space into mixed-use or warehouse facilities. For lenders, debt restructuring was more common during this period, as properties faced significant downward pressure on rents.

Post-Pandemic Recovery and the Role of Innovation (2022 – 2025)

The period from 2022 to 2025 marks the post-pandemic recovery phase for Illinois’ commercial real estate sector. While some industries have bounced back quickly, others are still grappling with the long-term effects of COVID-19 shot-downs, such as the decline of office demand and the shift towards hybrid work models. However, new strategies and innovations in distressed asset management are reshaping the future of CRE workouts.

Key Elements of CRE Workouts in Illinois During This Period:

- Hybrid and Remote Work Impact: The shift to hybrid and remote work has fundamentally changed demand for office space in Illinois, particularly in downtown Chicago. Lenders and property owners are finding new ways to repurpose office space to meet the demand for flex space, co-working environments, or even residential conversions. Workouts for office buildings now often include strategies for converting space to other uses.

- New Legislative Measures (e.g., the Illinois Receivership Act, HB28): Legal and regulatory changes have also played a role in shaping the current landscape. The passage of laws such as the Illinois Receivership Act, HB28 in Illinois, which expands the receivership process, allows for quicker intervention and better asset management in distressed commercial real estate. The ability to appoint receivers more easily has given lenders greater control and helped to streamline the workout process.

- Technology in Asset Management: The use of PropTech (property technology) has become a vital tool in CRE workouts. Platforms that enable landlords, lenders, and asset managers to track financial health, tenant activity, and market conditions have become more sophisticated. These tools allow for quicker decision-making, better risk management, and more efficient negotiations in distressed asset situations.

- Focus on ESG (Environmental, Social, and Governance): Another major trend is the increasing focus on ESG in commercial real estate. As sustainability becomes a higher priority for tenants and investors, distressed asset managers are incorporating ESG criteria into their workout strategies. This includes retrofitting buildings to be more energy-efficient, ensuring tenant satisfaction, and positioning properties for future growth.

2026 Outlook – Implications for Loan Workouts

The economic pressures building across Illinois in late 2025 are expected to significantly impact the volume, complexity, and urgency of loan workouts in 2026—particularly in consumer lending and commercial real estate (CRE).

1. Rising Consumer Defaults Will Drive an Increase in Retail Loan Workouts

As Illinois households struggle under the weight of rising credit card debt, auto loan delinquencies, and early mortgage stress, lenders will likely see a sharp uptick in consumer-level loan restructuring requests. Borrowers facing job losses or reduced income may seek temporary forbearance or extended payment plans. Lenders may need to expand workout teams or automate parts of the process to handle the volume efficiently.

In communities like Rockford, Peoria, and parts of Southern Illinois—where economic resilience is weaker—default rates could climb faster, leading to a higher concentration of loss mitigation activity. Regulatory pressure may also grow, encouraging banks and credit unions to offer flexible repayment options before pursuing more aggressive recovery.

2. Commercial Real Estate Workouts Will Become More Common—and Complex

The persistent challenges in Illinois’ CRE sector, particularly in Chicago’s office market, will likely trigger a new wave of distressed CRE workouts in 2026. Increasing property taxes, higher cost of insurance, high vacancy rates, declining rents, and compressed property values are already prompting landlords to seek loan modifications or deferments. As refinancing becomes more difficult amid tighter lending standards, many properties will require creative restructuring solutions to avoid default.

Expect lenders to increasingly rely on data-driven valuation models and scenario analysis to assess which borrowers can be stabilized through loan extensions, partial write-downs, or equity infusions. Those with significant exposure or underperforming properties will be under pressure to act decisively to preserve asset value.

3. Property Value Declines Will Complicate Residential Workouts

In suburban markets, where real estate prices are beginning to soften, loan-to-value (LTV) ratios may shift unfavorably for borrowers. For lenders, this increases the risk of loss in the event of foreclosure—and raises the likelihood of pursuing workouts instead.

Borrowers unable to refinance due to high interest rates or income loss may seek modifications, especially in areas with high property taxes and stagnating prices. However, lower collateral values will limit restructuring options, and lenders may be forced to accept deeper concessions to avoid full default scenarios.

4. Policy Constraints May Limit Workout Flexibility

I believe that in 2026, loan workouts in Illinois will shift from being targeted and reactive to widespread and strategic. Lenders will need to prepare for increased volume across both consumer and CRE portfolios, while navigating falling asset values, reduced borrower capacity, and tighter credit conditions. The quality and agility of loan workout strategies will be central to how well banks, credit unions, and servicers weather the coming cycle.

AI and the Future of CRE Workouts: Transforming Lender Strategies

As commercial real estate (CRE) markets face growing complexities, artificial intelligence (AI) is emerging as a critical tool for lenders navigating distressed asset management and workouts. However, the approach banks take toward AI adoption varies depending on its application—internally within their operations versus externally for market insights.

Internal AI Tools: Emerging with Caution

Internally, the integration of AI within banks remains in its early stages. While the potential benefits—such as risk identification, predictive modeling, and automation of complex decision-making—are clear, widespread adoption is restrained by pressing concerns. Privacy and confidentiality of client data, cybersecurity threats, and regulatory scrutiny are key considerations. As a result, many institutions are proceeding cautiously, piloting AI-driven tools within tightly controlled environments to evaluate their performance and compliance before broader deployment.

These early-stage internal AI tools could eventually enhance how lenders manage distressed CRE assets. For example, AI models might analyze loan performance data or identify early signs of default risk. Yet, the road to implementation is gradual, shaped by the need to align innovation with governance, data integrity, and evolving regulatory expectations.

External AI Tools: Gaining Momentum in Strategic Decision-Making

In contrast, banks are more open to leveraging AI externally—particularly for market intelligence, data aggregation, and forecasting. Here, AI can be making more tangible impact. By analyzing vast datasets from public markets, economic indicators, and property-level trends, external AI tools help lenders anticipate shifts in CRE demand, identify geographic vulnerabilities, and track macroeconomic changes that could influence loan performance.

These tools enable more informed decision-making around portfolio restructuring and future workouts. For instance, AI can assist in modeling various debt restructuring scenarios or benchmarking performance across markets, allowing lenders to offer customized workout strategies tailored to current and projected conditions. This not only supports stronger borrower-lender negotiations but also helps optimize recovery strategies.

Bridging Strategy with Insight

As AI capabilities evolve, the distinction between internal and external applications will blur—but for now, banks continue to balance innovation with caution. Internally, the focus remains on secure, compliant integration, while externally, AI is already reshaping how lenders understand market trends and adapt to emerging risks.

Ultimately, AI holds immense potential to transform the CRE workout process—from predictive risk analysis to personalized restructuring solutions. Whether used cautiously within bank systems or more freely for external insights, AI is poised to play a growing role in helping lenders respond faster, act smarter, and protect asset value in a volatile market environment.

Conclusion – A More Sophisticated, Tech-Driven Future

The evolution of commercial real estate workouts in Illinois from 2008 to 2025 reveals an industry that has learned to adapt to changing economic, legal, and market conditions. From the height of the financial crisis to the disruptive effects of COVID-19 shot-downs, the CRE sector has continually reshaped its approach to distressed asset management. As technology, new regulations, and changing market dynamics continue to influence the landscape, the future of CRE workouts in Illinois will likely involve even more innovation and flexibility. Stakeholders will continue to leverage technological advancements, adapt to new work environments, and embrace legislative changes to navigate the complexities of the post-pandemic world.

In the end, the lessons learned during these transformative years will continue to influence how Illinois’ commercial real estate market manages distressed assets, ensuring that the industry remains resilient and capable of weathering future economic challenges.

About the Author

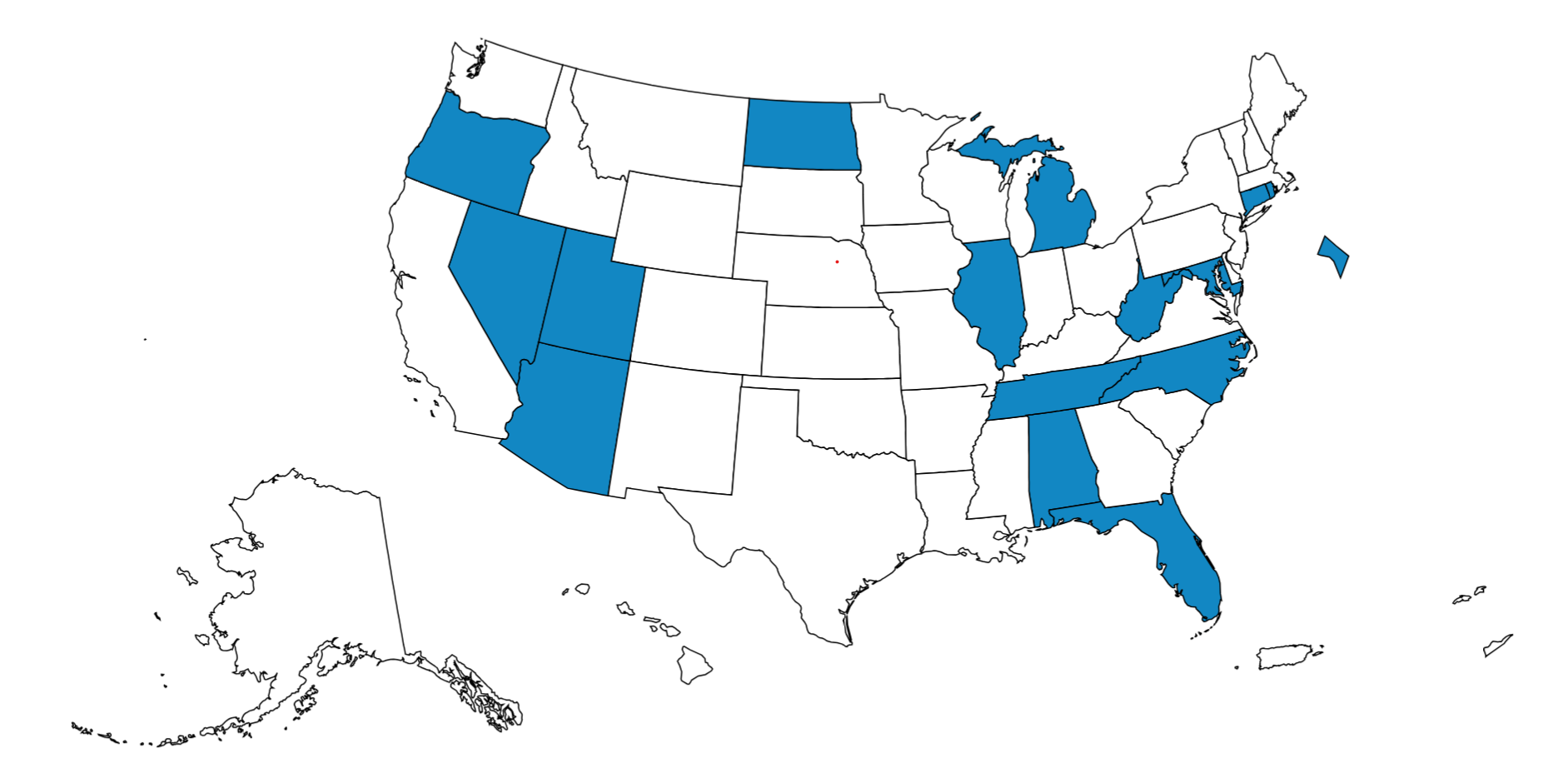

Arthur R. van der Vant, Illinois Receiver, is a highly experienced professional in the field of commercial real estate, specializing as a court-appointed receiver and asset manager throughout Illinois. With a proven track record of successfully navigating distressed asset situations, Arthur has consistently helped both lenders and property owners achieve optimal outcomes during complex real estate workouts. His expertise spans receivership management, loan workouts, real estate restructuring, and the intricate legal frameworks governing distressed properties.

Arthur R. van der Vant, Illinois Receiver, is a highly experienced professional in the field of commercial real estate, specializing as a court-appointed receiver and asset manager throughout Illinois. With a proven track record of successfully navigating distressed asset situations, Arthur has consistently helped both lenders and property owners achieve optimal outcomes during complex real estate workouts. His expertise spans receivership management, loan workouts, real estate restructuring, and the intricate legal frameworks governing distressed properties.

Arthur’s in-depth knowledge of Illinois’ commercial real estate market, combined with his financial acumen and innovative strategies, has contributed significantly to the stabilization and recovery of numerous properties. As a recognized leader in the field, he remains at the forefront of the evolving landscape of commercial real estate, distressed asset management, and receivership, offering valuable insights and guidance to stakeholders across the industry.

Contact

Arthur R. van der Vant, Illinois Receiver 312-607-4646 vandervant@IllinoisReceiver.com IllinoisReceiver.com