Setting Rental Rates and Negotiating Leases for Residential Properties

Setting rental rates and negotiating leases affect cash flow, occupancy, and long term value. For single family and multifamily residential properties, these steps require research, strategy, and clear communication. This guide explains how to set rent prices, attract quality tenants, and negotiate leases that protect your investment.

Understanding Your Rental Market

First, study your local rental market. Market knowledge drives smart pricing decisions. Compare similar properties in your area. Look at unit size, location, amenities, and condition. Use online listings to see current asking rents. This step answers a key question, how to set rent price correctly.

Next, track vacancy rates. High vacancies suggest softer demand. Lower demand often requires competitive pricing. In contrast, low vacancy rates support higher rents. Also, consider seasonality. Rental demand often peaks in spring and summer.

Finally, review local regulations. Some cities limit rent increases or require disclosures. Knowing the law prevents costly mistakes.

Calculating the Right Rent Price

To set rent, start with your costs. Include mortgage payments, utilities, taxes, and repairs. Add rental property insurance premiums. Then, factor in maintenance reserves and management fees. Many owners work with the best property management company to refine these numbers.

After that, analyze income goals. Decide if you want maximum cash flow or long term appreciation. Multifamily owners often accept lower margins for stable occupancy. Single family owners may aim for higher margins.

However, avoid emotional pricing. Overpriced rentals sit vacant. Vacancy costs more than modest rent reductions. Competitive pricing attracts better tenants and reduces turnover.

Marketing and Advertising Your Rental

Once you set the rent, focus on exposure. Owners often ask how to advertise rental property effectively. Start with high quality photos and clear descriptions. Highlight features tenants value, like parking, laundry, and outdoor space.

Post listings on major rental websites. Use social media to expand reach. Yard signs still work for single family homes. For multifamily buildings, consider a dedicated website.

Moreover, respond quickly to inquiries. Fast responses show professionalism and build trust. Many successful owners rely on professional managers to handle marketing and leasing.

Tenant Screening and Lease Preparation

Strong tenant selection supports stable income. Use professional tenant screening services to reduce risk. Screening should include credit checks, income verification, and rental history. Consistent criteria help avoid discrimination claims.

After selecting a tenant, prepare a clear lease. The lease should outline rent, due dates, fees, and maintenance responsibilities. Include rules on pets, guests, and noise. For multifamily properties, consistency across units matters.

Also, explain the lease in person or virtually. Clear explanations reduce disputes later. Transparency builds better landlord tenant relationships.

Negotiating Lease Terms Effectively

Negotiation does not mean giving up control. Instead, focus on value. Tenants may ask for lower rent or upgrades. Consider non price concessions first. For example, offer a longer lease term or small improvements.

For multifamily properties, small concessions can scale across units. Therefore, set limits in advance. Decide what you can offer without hurting returns.

However, know when to say no. If a tenant pushes unreasonable terms, move on. Strong demand allows firmness. Weak demand requires flexibility. Balance matters.

Managing Risk and Protecting Your Investment

Risk management plays a key role in leasing. Adequate rental property insurance protects against loss. Policies should cover liability, property damage, and loss of income. Review coverage annually.

Maintenance also affects value and rent. Tenants pay more for well maintained homes. Many owners search for property maintenance services near me to ensure fast repairs. Quick responses reduce complaints and turnover.

In addition, understand legal remedies. Know how to evict a tenant legally if issues arise. Follow state and local laws carefully. Improper evictions lead to fines and delays.

Financial Considerations for Landlords

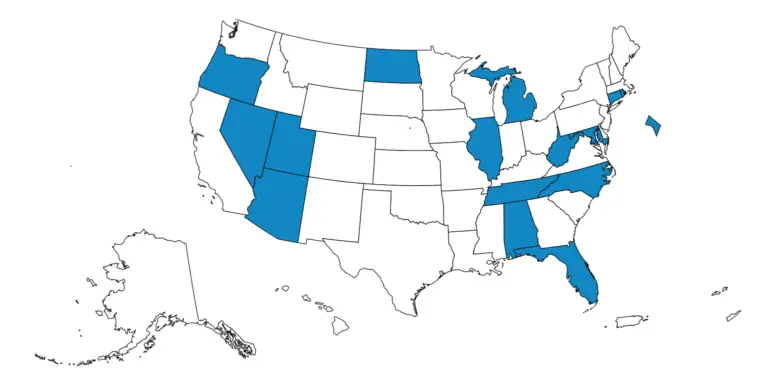

Financial planning supports sustainable rental income. Track expenses carefully. Many costs qualify for tax benefits. For example, property tax deductions for landlords Illinois can reduce taxable income. Consult a tax professional for guidance.

Depreciation, repairs, and management fees often qualify as deductions. Accurate records simplify tax filing and audits. Use accounting software or professional services.

For multifamily owners, economies of scale matter. Shared systems reduce per unit costs. This advantage allows competitive rents and stronger margins.

Working With Property Management Professionals

Many owners partner with the best property management company to handle leasing and operations. Managers provide market insights, pricing advice, and legal compliance. They also coordinate marketing, screening, and maintenance.

Professional management saves time and reduces stress. It also improves tenant retention. Happy tenants renew leases more often. For out of state owners, management is often essential.

However, choose managers carefully. Review contracts, fees, and service scope. Good managers act as partners, not just vendors.

Long Term Strategies for Single and Multifamily Properties

Successful landlords think long term. Review rents annually. Adjust based on market data and property upgrades. Gradual increases protect cash flow and tenant relationships.

Invest in improvements that justify higher rents. Energy efficient upgrades, modern kitchens, and secure access add value. For multifamily buildings, shared amenities boost appeal.

Finally, stay educated. Laws, markets, and tenant expectations change. Continuous learning improves decision making and profitability.

Conclusion

Setting rental rates and negotiating leases require planning and discipline. Research your market, calculate costs, and price competitively. Market effectively and screen tenants carefully. Negotiate with confidence and protect your investment.

Whether you manage one home or a large multifamily portfolio, these principles apply. With the right approach, rental properties deliver steady income and long term growth.

About Author

Arthur R. van der Vant is an accomplished property manager with over 38 years of experience managing residential and commercial properties across Illinois. With a deep understanding of Illinois landlord-tenant law and other vital housing regulations, Arthur is dedicated to ensuring both property owners and tenants are informed and protected. Known for providing expert guidance on compliance, risk management, and tenant relations, Arthur offers practical insights that help landlords navigate the complexities of property management while maintaining a strong commitment to fairness and tenant safety.

Arthur R. van der Vant is an accomplished property manager with over 38 years of experience managing residential and commercial properties across Illinois. With a deep understanding of Illinois landlord-tenant law and other vital housing regulations, Arthur is dedicated to ensuring both property owners and tenants are informed and protected. Known for providing expert guidance on compliance, risk management, and tenant relations, Arthur offers practical insights that help landlords navigate the complexities of property management while maintaining a strong commitment to fairness and tenant safety.