Creating a Successful Budget for Your Rental Properties

When managing rental properties, a clear and effective budget is key to maintaining profitability and ensuring the long-term success of your investments. Proper financial planning helps you account for all necessary expenses while maximizing income. In this article, we will guide you through the process of creating a successful budget for your rental properties.

1. Understanding Your Income

The first step in budgeting for your rental properties is calculating your total income. This includes rent payments and any additional fees. You should determine how much you can expect to earn each month from your tenants. To get the best results, it’s essential to know how to set rent price based on the market rate in your area. Research comparable properties and evaluate factors like location, size, and amenities.

Additionally, consider additional income sources like laundry facilities, parking fees, or late payment charges. Always ensure you track income consistently to avoid surprises. Keep in mind that some months may have vacancies, so it’s important to plan for these periods in advance.

2. Property Maintenance Costs

Maintenance is an ongoing cost that must be accounted for in your budget. Regular upkeep of your rental property is vital to ensure it stays in good condition and remains appealing to tenants. Property maintenance services near me are available for regular tasks like lawn care, HVAC maintenance, and plumbing services.

When budgeting for maintenance, consider creating an emergency fund for unexpected repairs. This will help cover unforeseen costs, such as fixing major appliances or dealing with plumbing issues. Having a reliable maintenance schedule and working with trusted service providers ensures the smooth operation of your property.

3. Property Management Fees

If you are using property management services, this expense should be included in your budget. Best property management services near me typically charge from 6% to 10% percent of the monthly rent collected. The rate may vary based on location, property size, and service offerings. Keep in mind that this service often includes tenant management, rent collection, and even property maintenance coordination.

Property managers also help with tenant screening services. These services are crucial to ensure you select reliable and responsible tenants. Tenant screening helps reduce the risk of late payments, property damage, and evictions. Consider whether outsourcing these tasks will save you time and reduce stress.

4. Insurance and Taxes

Another critical aspect of budgeting for rental properties is insurance. Rental property insurance protects your property from damage, theft, or liability claims. It’s important to choose a policy that covers not only the building itself but also your tenants’ belongings and potential loss of rental income. Be sure to shop around for the best rates and coverage that suits your needs.

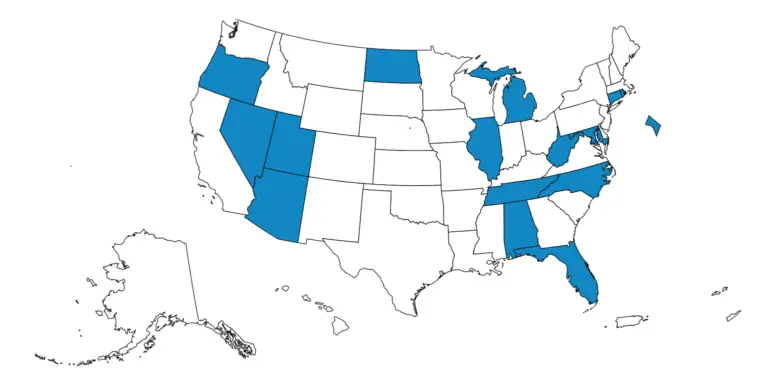

On the tax front, landlords can benefit from various property tax deductions. In Illinois, property tax deductions for landlords are available, which can help reduce your overall tax burden. Consult with a tax professional to ensure you take advantage of all available deductions, such as those for mortgage interest, property depreciation, and repairs.

5. Tenant and Lease Costs

When setting up your budget, make sure you account for tenant-related expenses. This includes costs associated with leasing, such as background checks, credit reports, and lease document preparation. Many landlords opt to use a property management company, that may streamline this process.

Also, remember to factor in eviction costs. While we hope it never comes to that, knowing how to evict a tenant legally and efficiently is part of being a responsible landlord. Understand local laws and budget for potential legal fees if evictions are necessary.

6. Marketing and Advertising Your Property

To maintain a steady stream of tenants, you’ll need to budget for advertising. Learning how to advertise rental property effectively is crucial for attracting high-quality tenants. Utilize online platforms like Zillow, Craigslist, or social media to reach a broad audience. Professional photos, detailed descriptions, and virtual tours can make your listing stand out.

If you are working with a property management company, they may handle the advertising for you. They will often know the best strategies for marketing rental properties in your area, saving you time and effort.

7. Handling Vacancy Periods

Vacancy periods can be unpredictable, but they are an inevitable part of property ownership. To prepare for these gaps in income, make sure to allocate funds to cover expenses during vacancies. This can include mortgage payments, utilities, insurance premiums, and maintenance costs.

One way to minimize vacancies is by ensuring you have a competitive rent price and a smooth tenant turnover process. You may also want to consider offering incentives like a free month’s rent for long-term leases to attract new tenants quickly.

8. Setting Aside Funds for Long-Term Investments

Lastly, a successful budget for your rental property should include saving for future improvements. Whether it’s updating the property, enhancing curb appeal, or adding new amenities, long-term investments can increase the value of your property. Set aside a portion of your rental income each month for future upgrades, which will help you remain competitive in the market.

9. Why Hiring a Management Company Saves Time and Money

How much does your time cost? What’s your hourly rate? Leasing a vacancy demands many hours of focused work, often 20 to 40 per unit. Those hours carry a real cost when you value your time. A professional management company streamlines the entire leasing process from pricing to move in. The best property management services already know how to advertise rental property, how to set rent price, and how to screen tenants efficiently. They also coordinate showings, handle paperwork, and ensure legal compliance. As a result, vacancies fill faster and with better tenants. Fewer mistakes also mean fewer costly issues later, such as late payments or learning how to evict a tenant. While management fees are an expense, they are often cheaper than lost rent, stress, and wasted hours. In the end, hiring a management company is both more time effective and, when calculated properly, more cost effective as well.

Conclusion

Creating a successful budget for your rental properties requires careful planning and organization. By considering all the expenses associated with property management, maintenance, insurance, and tenant-related costs, you can ensure that your rental properties remain profitable. Keep track of income, manage expenses wisely, and allocate funds for unexpected costs or future upgrades.

Additionally, partnering with the best property management company like Three Pentacles, PLLC and leveraging many of their services, like tenant screening, can help streamline your operations. By understanding how to advertise rental property, how to set rent price, and the legalities of evictions, you can make smarter decisions for your investments.

With a well-thought-out budget in place, your rental properties will continue to generate income and grow in value over time.

Three Pentacles, PLLC